000008483912-312024Q1falsehttp://rollins.com/20240331#CustomerServicesMemberhttp://rollins.com/20240331#CustomerServicesMemberhttp://rollins.com/20240331#CustomerServicesMemberhttp://rollins.com/20240331#CustomerServicesMember23800000848392024-01-012024-03-3100000848392024-04-15xbrli:shares00000848392024-03-31iso4217:USD00000848392023-12-310000084839us-gaap:CustomerContractsMember2024-03-310000084839us-gaap:CustomerContractsMember2023-12-310000084839us-gaap:TrademarksAndTradeNamesMember2024-03-310000084839us-gaap:TrademarksAndTradeNamesMember2023-12-310000084839us-gaap:OtherIntangibleAssetsMember2024-03-310000084839us-gaap:OtherIntangibleAssetsMember2023-12-31iso4217:USDxbrli:shares00000848392023-01-012023-03-310000084839us-gaap:CommonStockMember2023-12-310000084839us-gaap:AdditionalPaidInCapitalMember2023-12-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000084839us-gaap:RetainedEarningsMember2023-12-310000084839us-gaap:RetainedEarningsMember2024-01-012024-03-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000084839us-gaap:CommonStockMember2024-01-012024-03-310000084839us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000084839us-gaap:CommonStockMember2024-03-310000084839us-gaap:AdditionalPaidInCapitalMember2024-03-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000084839us-gaap:RetainedEarningsMember2024-03-310000084839us-gaap:CommonStockMember2022-12-310000084839us-gaap:AdditionalPaidInCapitalMember2022-12-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000084839us-gaap:RetainedEarningsMember2022-12-3100000848392022-12-310000084839us-gaap:RetainedEarningsMember2023-01-012023-03-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000084839us-gaap:CommonStockMember2023-01-012023-03-310000084839us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000084839us-gaap:CommonStockMember2023-03-310000084839us-gaap:AdditionalPaidInCapitalMember2023-03-310000084839us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000084839us-gaap:RetainedEarningsMember2023-03-3100000848392023-03-31rol:business0000084839rol:Acquisitions2024Member2024-03-310000084839us-gaap:CustomerContractsMemberrol:Acquisitions2024Member2024-03-310000084839us-gaap:TrademarksAndTradeNamesMemberrol:Acquisitions2024Member2024-03-310000084839us-gaap:OtherIntangibleAssetsMemberrol:Acquisitions2024Member2024-03-310000084839rol:FPCHoldingsLLCMember2023-04-01xbrli:pure00000848392023-04-030000084839rol:FPCHoldingsLLCMember2023-04-012023-04-010000084839rol:FPCHoldingsLLCMember2024-03-310000084839us-gaap:TrademarksAndTradeNamesMemberrol:FPCHoldingsLLCMember2024-03-310000084839rol:FPCHoldingsLLCMember2024-01-012024-03-310000084839us-gaap:CustomerContractsMember2024-03-310000084839country:US2024-01-012024-03-310000084839country:US2023-01-012023-03-310000084839us-gaap:NonUsMember2024-01-012024-03-310000084839us-gaap:NonUsMember2023-01-012023-03-310000084839rol:ResidentialRevenueMember2024-01-012024-03-310000084839rol:ResidentialRevenueMember2023-01-012023-03-310000084839rol:CommercialRevenueMember2024-01-012024-03-310000084839rol:CommercialRevenueMember2023-01-012023-03-310000084839rol:TermiteCompletionsBaitMonitoringRenewalsAncillaryMember2024-01-012024-03-310000084839rol:TermiteCompletionsBaitMonitoringRenewalsAncillaryMember2023-01-012023-03-310000084839us-gaap:FranchiseMember2024-01-012024-03-310000084839us-gaap:FranchiseMember2023-01-012023-03-310000084839rol:OtherRevenueMember2024-01-012024-03-310000084839rol:OtherRevenueMember2023-01-012023-03-310000084839us-gaap:OtherCurrentAssetsMember2024-03-310000084839us-gaap:OtherAssetsMember2024-03-3100000848392022-01-012022-12-310000084839us-gaap:TradeAccountsReceivableMember2023-12-310000084839us-gaap:FinanceReceivablesMember2023-12-310000084839us-gaap:TradeAccountsReceivableMember2024-01-012024-03-310000084839us-gaap:FinanceReceivablesMember2024-01-012024-03-310000084839us-gaap:TradeAccountsReceivableMember2024-03-310000084839us-gaap:FinanceReceivablesMember2024-03-310000084839us-gaap:TradeAccountsReceivableMember2022-12-310000084839us-gaap:FinanceReceivablesMember2022-12-310000084839us-gaap:TradeAccountsReceivableMember2023-01-012023-03-310000084839us-gaap:FinanceReceivablesMember2023-01-012023-03-310000084839us-gaap:TradeAccountsReceivableMember2023-03-310000084839us-gaap:FinanceReceivablesMember2023-03-310000084839us-gaap:CustomerContractsMember2023-12-310000084839srt:MinimumMemberus-gaap:CustomerContractsMember2024-03-310000084839srt:MinimumMemberus-gaap:CustomerContractsMember2023-12-310000084839srt:MaximumMemberus-gaap:CustomerContractsMember2023-12-310000084839srt:MaximumMemberus-gaap:CustomerContractsMember2024-03-310000084839us-gaap:TrademarksAndTradeNamesMember2024-03-310000084839us-gaap:TrademarksAndTradeNamesMember2023-12-310000084839srt:MinimumMemberus-gaap:TrademarksAndTradeNamesMember2023-12-310000084839srt:MinimumMemberus-gaap:TrademarksAndTradeNamesMember2024-03-310000084839srt:MaximumMemberus-gaap:TrademarksAndTradeNamesMember2024-03-310000084839srt:MaximumMemberus-gaap:TrademarksAndTradeNamesMember2023-12-310000084839us-gaap:NoncompeteAgreementsMember2024-03-310000084839us-gaap:NoncompeteAgreementsMember2023-12-310000084839srt:MinimumMemberus-gaap:NoncompeteAgreementsMember2023-12-310000084839srt:MinimumMemberus-gaap:NoncompeteAgreementsMember2024-03-310000084839srt:MaximumMemberus-gaap:NoncompeteAgreementsMember2024-03-310000084839srt:MaximumMemberus-gaap:NoncompeteAgreementsMember2023-12-310000084839us-gaap:FairValueInputsLevel2Member2024-03-310000084839us-gaap:FairValueInputsLevel2Member2023-12-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-03-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-03-310000084839us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-03-310000084839us-gaap:RevolvingCreditFacilityMember2023-02-240000084839us-gaap:RevolvingCreditFacilityMemberrol:SwingLineLoansMember2023-02-240000084839us-gaap:RevolvingCreditFacilityMemberrol:TranchesTermLoanMember2023-02-240000084839us-gaap:RevolvingCreditFacilityMemberus-gaap:InterestRateFloorMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMember2023-02-242023-02-240000084839srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberrol:OneMonthSecuredOvernightFinancingRateSOFRMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberrol:OneMonthSecuredOvernightFinancingRateSOFRMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMemberrol:OneMonthSecuredOvernightFinancingRateSOFRMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMember2023-02-242023-02-240000084839srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-02-242023-02-240000084839us-gaap:RevolvingCreditFacilityMember2024-03-310000084839us-gaap:RevolvingCreditFacilityMember2023-12-310000084839rol:A2019CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000084839us-gaap:LetterOfCreditMember2024-03-310000084839us-gaap:LetterOfCreditMember2023-12-310000084839us-gaap:LineOfCreditMember2024-01-012024-03-310000084839us-gaap:LineOfCreditMember2024-03-310000084839rol:RestrictedSharesAndPerformanceSharesMember2024-01-012024-03-310000084839rol:RestrictedSharesAndPerformanceSharesMember2023-01-012023-03-310000084839us-gaap:EmployeeStockMember2024-01-012024-03-310000084839us-gaap:CommonStockMember2024-01-012024-03-310000084839us-gaap:CommonStockMember2023-01-012023-03-310000084839rol:TimeLapseRestrictedSharesMember2024-01-012024-03-310000084839rol:TimeLapseRestrictedSharesMember2023-01-012023-03-310000084839us-gaap:SubsequentEventMember2024-04-232024-04-230000084839rol:OfficerTradingArrangementMember2024-01-012024-03-310000084839rol:JerryEGahlhoffJrMember2024-01-012024-03-310000084839rol:JerryEGahlhoffJrMember2024-03-310000084839rol:ThomasDTeshMemberrol:OfficerTradingArrangementMember2024-01-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-4422

ROLLINS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 51-0068479 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2170 Piedmont Road, N.E., Atlanta, Georgia

(Address of principal executive offices)

30324

(Zip Code)

(404) 888-2000

(Registrant’s telephone number, including area code)

___________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | ROL | | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large Accelerated Filer | x | | Accelerated filer | o |

| Non-accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

Rollins, Inc. had 484,230,396 shares of its $1 par value Common Stock outstanding as of April 15, 2024.

ROLLINS, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

ROLLINS, INC. AND SUBSIDIARIES

PART 1 FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF MARCH 31, 2024 AND DECEMBER 31, 2023

(in thousands except share data)

(unaudited)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 112,971 | | | $ | 103,825 | |

Trade receivables, net of allowance for expected credit losses of $14,864 and $15,797, respectively | 177,254 | | | 178,214 | |

Financed receivables, short-term, net of allowance for expected credit losses of $1,914 and $1,874, respectively | 35,717 | | | 37,025 | |

| Materials and supplies | 35,698 | | | 33,383 | |

| Other current assets | 62,713 | | | 54,192 | |

| Total current assets | 424,353 | | | 406,639 | |

Equipment and property, net of accumulated depreciation of $366,779 and $360,421, respectively | 127,116 | | | 126,661 | |

| Goodwill | 1,095,141 | | | 1,070,310 | |

| Customer contracts, net | 389,199 | | | 386,152 | |

| Trademarks & tradenames, net | 151,821 | | | 151,368 | |

| Other intangible assets, net | 8,370 | | | 8,214 | |

| Operating lease right-of-use assets | 341,639 | | | 323,390 | |

Financed receivables, long-term, net of allowance for expected credit losses of $4,342 and $3,728, respectively | 79,040 | | | 75,909 | |

| Other assets | 41,940 | | | 46,817 | |

| Total assets | $ | 2,658,619 | | | $ | 2,595,460 | |

| LIABILITIES | | | |

| Accounts payable | $ | 40,038 | | | $ | 49,200 | |

| Accrued insurance - current | 51,660 | | | 46,807 | |

| Accrued compensation and related liabilities | 79,372 | | | 114,355 | |

| Unearned revenues | 186,021 | | | 172,380 | |

| Operating lease liabilities - current | 97,394 | | | 92,203 | |

| | | |

| Other current liabilities | 137,451 | | | 101,744 | |

| Total current liabilities | 591,936 | | | 576,689 | |

| Accrued insurance, less current portion | 51,928 | | | 48,060 | |

| Operating lease liabilities, less current portion | 246,614 | | | 233,369 | |

| Long-term debt | 510,909 | | | 490,776 | |

| Other long-term accrued liabilities | 89,736 | | | 90,999 | |

| Total liabilities | 1,491,123 | | | 1,439,893 | |

| Commitments and contingencies (see Note 9) | | | |

| STOCKHOLDERS’ EQUITY | | | |

Preferred stock, without par value; 500,000 shares authorized, zero shares issued | — | | | — | |

Common stock, par value $1 per share; 800,000,000 shares authorized, 484,230,396 and 484,080,014 shares issued and outstanding, respectively | 484,230 | | | 484,080 | |

| Additional paid in capital | 127,531 | | | 131,840 | |

| Accumulated other comprehensive loss | (32,472) | | | (26,755) | |

| Retained earnings | 588,207 | | | 566,402 | |

| Total stockholders’ equity | 1,167,496 | | | 1,155,567 | |

| Total liabilities and stockholders’ equity | $ | 2,658,619 | | | $ | 2,595,460 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands except per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| REVENUES | | | | | | | |

| Customer services | | | | | $ | 748,349 | | | $ | 658,015 | |

| COSTS AND EXPENSES | | | | | | | |

| Cost of services provided (exclusive of depreciation and amortization below) | | | | | 365,558 | | | 326,842 | |

| Sales, general and administrative | | | | | 223,057 | | | 196,431 | |

| | | | | | | |

| Depreciation and amortization | | | | | 27,310 | | | 22,502 | |

| Total operating expenses | | | | | 615,925 | | | 545,775 | |

| OPERATING INCOME | | | | | 132,424 | | | 112,240 | |

| Interest expense, net | | | | | 7,725 | | | 465 | |

| Other expense (income), net | | | | | 61 | | | (4,714) | |

| CONSOLIDATED INCOME BEFORE INCOME TAXES | | | | | 124,638 | | | 116,489 | |

| PROVISION FOR INCOME TAXES | | | | | 30,244 | | | 28,255 | |

| NET INCOME | | | | | $ | 94,394 | | | $ | 88,234 | |

| NET INCOME PER SHARE - BASIC AND DILUTED | | | | | $ | 0.19 | | | $ | 0.18 | |

| Weighted average shares outstanding – basic | | | | | 484,131 | | 492,516 |

| Weighted average shares outstanding – diluted | | | | | 484,318 | | 492,701 |

| DIVIDENDS PAID PER SHARE | | | | | $ | 0.15 | | | $ | 0.13 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| NET INCOME | | | | | $ | 94,394 | | | $ | 88,234 | |

| Other comprehensive (loss) income, net of tax: | | | | | | | |

| Foreign currency translation adjustments | | | | | (5,774) | | | 97 | |

| Unrealized gain on available for sale securities | | | | | 57 | | | 162 | |

| | | | | | | |

| Other comprehensive (loss) income, net of tax | | | | | (5,717) | | | 259 | |

| Comprehensive income | | | | | $ | 88,677 | | | $ | 88,493 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Paid-in-

Capital | | Accumulated Other

Comprehensive

Income / (Loss) | | Retained

Earnings | | Total |

| Shares | | Amount | | | | |

| Balance at December 31, 2023 | 484,080 | | $ | 484,080 | | | $ | 131,840 | | | $ | (26,755) | | | $ | 566,402 | | | $ | 1,155,567 | |

| Net income | — | | | — | | | — | | | — | | | 94,394 | | | 94,394 | |

| Other comprehensive (loss) income, net of tax: | | | | | | | | | | | |

| Foreign currency translation adjustments | — | | — | | — | | (5,774) | | — | | (5,774) | |

| Unrealized gains on available for sale securities | — | | — | | — | | 57 | | — | | 57 | |

| Cash dividends | — | | — | | — | | — | | (72,589) | | (72,589) | |

| Stock compensation | 414 | | 414 | | 6,767 | | — | | — | | 7,181 | |

| Shares withheld for payment of employee taxes | (264) | | (264) | | (11,076) | | — | | — | | (11,340) | |

| | | | | | | | | | | |

| Balance at March 31, 2024 | 484,230 | | $ | 484,230 | | | $ | 127,531 | | | $ | (32,472) | | | $ | 588,207 | | | $ | 1,167,496 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Paid-in-

Capital | | Accumulated Other

Comprehensive

Income / (Loss) | | Retained

Earnings | | Total |

| Shares | | Amount | | | | |

| Balance at December 31, 2022 | 492,448 | | $ | 492,448 | | | $ | 119,242 | | | $ | (31,562) | | | $ | 687,069 | | | $ | 1,267,197 | |

| Net income | — | | — | | | — | | | — | | | 88,234 | | | 88,234 | |

| Other comprehensive (loss) income, net of tax: | | | | | | | | | | | |

| Foreign currency translation adjustments | — | | — | | | — | | | 97 | | | — | | | 97 | |

| Unrealized gains on available for sale securities | — | | — | | | — | | | 162 | | | — | | | 162 | |

| Cash dividends | — | | — | | | — | | | — | | | (64,053) | | | (64,053) | |

| Stock compensation | 601 | | 601 | | 5,346 | | | — | | | — | | | 5,947 | |

| Shares withheld for payment of employee taxes | (262) | | (262) | | (9,570) | | | — | | | — | | | (9,832) | |

| Balance at March 31, 2023 | 492,787 | | $ | 492,787 | | | $ | 115,018 | | | $ | (31,303) | | | $ | 711,250 | | | $ | 1,287,752 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands)

(unaudited) | | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2024 | | 2023 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 94,394 | | | $ | 88,234 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 27,310 | | | 22,502 | |

| Stock-based compensation expense | 7,181 | | | 5,947 | |

| Provision for expected credit losses | 7,693 | | | 3,896 | |

| Gain on sale of assets, net | (368) | | | (4,714) | |

| Provision for deferred income taxes | — | | | 6,929 | |

| Changes in operating assets and liabilities: | | | |

| Trade accounts receivable | (6,400) | | | 1,533 | |

| Financing receivables | (1,822) | | | (4,421) | |

| Materials and supplies | (2,286) | | | (1,043) | |

| Other current assets | (8,867) | | | (1,501) | |

| Accounts payable and accrued expenses | (9,396) | | | (17,548) | |

| Unearned revenue | 13,691 | | | 8,656 | |

| Other long-term assets and liabilities | 6,303 | | | (7,697) | |

| Net cash provided by operating activities | 127,433 | | | 100,773 | |

| INVESTING ACTIVITIES | | | |

| Acquisitions, net of cash acquired | (47,132) | | | (15,480) | |

| Capital expenditures | (7,171) | | | (7,636) | |

| Proceeds from sale of assets | 712 | | | 8,886 | |

| Other investing activities, net | 1,126 | | | 640 | |

| Net cash used in investing activities | (52,465) | | | (13,590) | |

| FINANCING ACTIVITIES | | | |

| Payment of contingent consideration | (1,474) | | | (4,098) | |

| | | |

| Borrowings under revolving commitment | 110,000 | | | 180,000 | |

| Repayments of term loan | — | | | (55,000) | |

| Repayments of revolving commitment | (90,000) | | | (115,000) | |

| Payment of dividends | (72,589) | | | (64,053) | |

| Cash paid for common stock purchased | (11,340) | | | (11,443) | |

| Other financing activities, net | 1,149 | | | (1,488) | |

| Net cash used in financing activities | (64,254) | | | (71,082) | |

| Effect of exchange rate changes on cash | (1,568) | | | 1,056 | |

| Net increase in cash and cash equivalents | 9,146 | | | 17,157 | |

| Cash and cash equivalents at beginning of period | 103,825 | | | 95,346 | |

| Cash and cash equivalents at end of period | $ | 112,971 | | | $ | 112,503 | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 8,707 | | | $ | 429 | |

| Cash paid for income taxes, net | $ | 5,591 | | | $ | 12,572 | |

| Non-cash additions to operating lease right-of-use assets | $ | 45,531 | | | $ | 20,828 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ROLLINS, INC. AND SUBSIDIARIES

NOTE 1. BASIS OF PREPARATION

Basis of Preparation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP, the instructions to Form 10-Q and applicable sections of Securities and Exchange Commission ("SEC") regulation S-X, and therefore do not include all information and footnotes required by U.S. GAAP for complete financial statements. There have been no material changes in the Company’s significant accounting policies or the information disclosed in the notes to the consolidated financial statements included in the Annual Report on Form 10-K of Rollins, Inc. (including its subsidiaries unless the context otherwise requires, “Rollins,” “we,” “us,” “our,” or the “Company”) for the year ended December 31, 2023. Accordingly, the quarterly condensed consolidated financial statements and related disclosures herein should be read in conjunction with the 2023 Annual Report on Form 10-K.

The Company’s condensed consolidated financial statements reflect estimates and assumptions made by management that affect the reported amounts of assets and liabilities and related disclosures as of the date of the condensed consolidated financial statements. The Company considered the impact of economic trends on the assumptions and estimates used in preparing the condensed consolidated financial statements. In the opinion of management, all material adjustments necessary for a fair presentation of the Company’s financial results for the quarter have been made. These adjustments are of a normal recurring nature but complicated by the continued uncertainty surrounding economic trends. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of results for the entire year. The severity, magnitude and duration of certain economic trends continue to be uncertain and are difficult to predict. Therefore, our accounting estimates and assumptions may change over time in response to economic trends and may change materially in future periods.

NOTE 2. RECENT ACCOUNTING PRONOUNCEMENTS

Accounting standards and disclosure rules issued but not yet adopted

In October 2023, the FASB issued Accounting Standards Update ("ASU") 2023-06, “Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative,” to amend certain disclosure and presentation requirements for a variety of topics within the Accounting Standards Codification ("ASC"). These amendments align the requirements in the ASC to the removal of certain disclosure requirements set out in Regulation S-X and Regulation S-K, announced by the SEC. The effective date for each amended topic in the ASC is either the date on which the SEC’s removal of the related disclosure requirement from Regulation S-X or Regulation S-K becomes effective, or on June 30, 2027, if the SEC has not removed the requirements by that date. Early adoption is prohibited. The Company does not expect that the application of this standard will have a material impact on its disclosures.

In November 2023, the FASB issued ASU 2023-07, "Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which is intended to improve reportable segment disclosure requirements, primarily through additional and more detailed information about a reportable segment's expenses. The guidance is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The guidance is to be applied retrospectively to all prior periods presented in the financial statements. Upon transition, the segment expense categories and amounts disclosed in the prior periods should be based on the significant segment expense categories identified and disclosed in the period of adoption. The Company is currently evaluating the potential impact of adopting this new guidance on its disclosures.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures” (“ASU 2023-09”), which is intended to enhance the transparency and decision usefulness of income tax disclosures. This amendment modifies the rules on income tax disclosures to require entities to disclose (1) specific categories in the rate reconciliation and additional information for reconciling items that meet a quantitative threshold, (2) the amount of income taxes paid (net of refunds received) (disaggregated by federal, state, and foreign taxes) as well as individual jurisdictions in which income taxes paid is equal to or greater than 5 percent of total income taxes paid net of refunds, (3) the income or loss from continuing operations before income tax expense or benefit (disaggregated between domestic and foreign) and (4) income tax expense or benefit from continuing operations (disaggregated by federal, state

ROLLINS, INC. AND SUBSIDIARIES

and foreign). The guidance is effective for annual periods beginning after December 15, 2024, with early adoption permitted for annual financial statements that have not yet been issued or made available for issuance. ASU 2023-09 should be applied on a prospective basis, while retrospective application is permitted. The Company is currently evaluating the potential impact of adopting this new guidance on its disclosures.

In March 2024, the SEC adopted the final rule under SEC Release No. 33-11275, The Enhancement and Standardization of Climate-Related Disclosures for Investors. This rule will require registrants to disclose certain climate-related information in registration statements and annual reports. The disclosure requirements will apply to the Company's fiscal year beginning January 1, 2025. The Company is currently evaluating the final rule to determine its impact on the Company's disclosures.

NOTE 3. ACQUISITIONS

2024 Acquisitions

The Company made 12 acquisitions during the three months ended March 31, 2024. The aggregate preliminary values of major classes of assets acquired and liabilities assumed recorded at the dates of acquisition are included in the reconciliation of the total preliminary consideration as follows (in thousands):

| | | | | |

| March 31, 2024 |

| |

| Accounts receivable | $ | 921 | |

| Materials and supplies | 206 | |

| Other current assets | 210 | |

| Equipment and property | 2,258 | |

| Goodwill | 27,337 | |

| Customer contracts | 21,514 | |

| Trademarks & tradenames | 1,012 | |

| Other intangible assets | 762 | |

| Current liabilities | (364) | |

| Unearned revenue | (58) | |

| Other assets and liabilities, net | (2) | |

| Assets acquired and liabilities assumed | $ | 53,796 | |

Included in the total consideration of $53.8 million are acquisition holdback liabilities of $6.7 million.

Goodwill from acquisitions represents the excess of the purchase price over the fair value of net assets of businesses acquired. The factors contributing to the amount of goodwill are based on strategic and synergistic benefits that are expected to be realized. A majority of the recognized goodwill is expected to be deductible for tax purposes. Valuations of certain assets and liabilities, including intangible assets and goodwill, as of the acquisition date have not been finalized at this time and are provisional.

Fox Pest Control Acquisition

On April 1, 2023, the Company acquired 100% of FPC Holdings, LLC (“Fox Pest Control”, or "Fox"). As part of funding the Fox acquisition, on April 3, 2023, the Company borrowed incremental amounts under the Credit Agreement of $305.0 million. The proceeds were used to pay cash consideration at closing.

Management believes that the acquisition will expand the Rollins family of brands and drive long term value given Fox's attractive financial profile and complementary end market exposure.

The Fox acquisition has been accounted for as a business combination, and the Fox results of operations are included in the Company's results of operations for the three months ended March 31, 2024. Fox contributed revenues of $35.5 million and net earnings of $1.5 million during the three months ended March 31, 2024.

ROLLINS, INC. AND SUBSIDIARIES

The valuation of the Fox acquisition was performed by a third-party valuation specialist under our management’s supervision. The values of identified assets acquired and liabilities assumed were finalized as of March 31, 2024 and are summarized in the table below (in thousands).

| | | | | |

| Final Fair Value as of March 31, 2024 |

| Cash | $ | 4,560 | |

| Accounts receivable | 1,542 | |

| Materials and supplies | 431 | |

| Operating lease right-of-use assets | 8,689 | |

| Other current assets | 487 | |

| |

| Goodwill | 188,176 | |

| Customer contracts | 118,000 | |

| Trademarks & tradenames | 38,000 | |

| Current liabilities | (5,538) | |

| Unearned revenue | (6,144) | |

| Operating lease liabilities | (8,689) | |

| Assets acquired and liabilities assumed | $ | 339,514 | |

The Company purchased Fox for $339.5 million. Included in the total consideration are cash payments of $302.8 million made upon closing, contingent consideration valued at $28.0 million that is based on Fox's financial performance in the twelve months following acquisition, and holdback liabilities valued at $8.7 million to be held by the Company to settle indemnity claims and working capital adjustments. The fair value of the contingent consideration was estimated using a Monte Carlo simulation. During the three months ended March 31, 2024, we recognized a charge of $1.0 million related to adjustments to the fair value of contingent consideration resulting from the acquisition of Fox. This charge is reported within sales, general and administrative expenses in our condensed consolidated statement of income.

Acquired customer contracts are estimated to have a remaining useful life of 7 years. The acquired trademarks and tradenames are expected to have an indefinite useful life.

Goodwill from this acquisition represents the excess of the purchase price over the fair value of net assets of the business acquired. The factors contributing to the amount of goodwill are based on strategic and synergistic benefits that are expected to be realized. The recognized goodwill is expected to be deductible for tax purposes.

NOTE 4. REVENUE

Revenue, classified by the major geographic areas in which our customers are located, was as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | |

| (in thousands) | | | | | 2024 | | 2023 | | | | |

| United States | | | | | $ | 693,860 | | | $ | 609,311 | | | | | |

| Other countries | | | | | 54,489 | | | 48,704 | | | | | |

| Total Revenues | | | | | $ | 748,349 | | | $ | 658,015 | | | | | |

ROLLINS, INC. AND SUBSIDIARIES

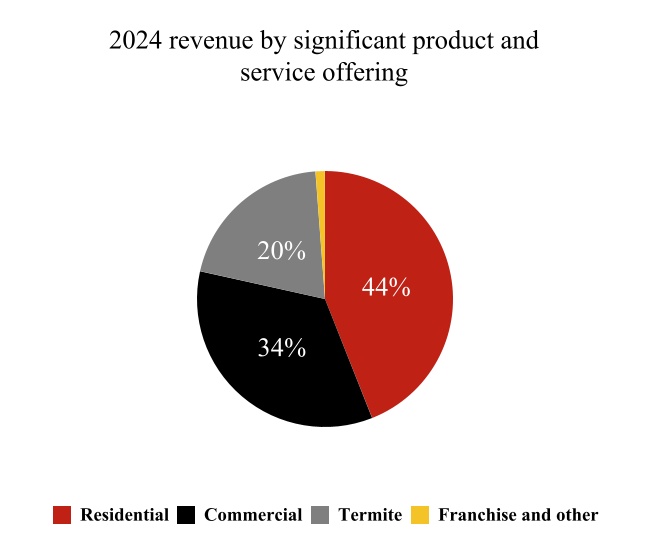

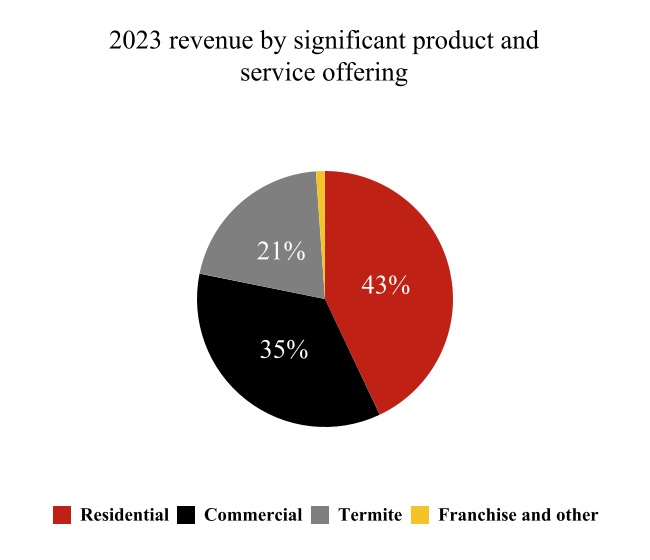

Revenue from external customers, classified by significant product and service offerings, was as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | |

| (in thousands) | | | | | 2024 | | 2023 | | | | |

| Residential revenue | | | | | $ | 329,338 | | | $ | 282,757 | | | | | |

| Commercial revenue | | | | | 258,114 | | | 231,707 | | | | | |

| Termite completions, bait monitoring, & renewals | | | | | 152,060 | | | 136,131 | | | | | |

| Franchise revenues | | | | | 3,961 | | | 3,789 | | | | | |

| Other revenues | | | | | 4,876 | | | 3,631 | | | | | |

| Total Revenues | | | | | $ | 748,349 | | | $ | 658,015 | | | | | |

Revenues classified by significant product and service offerings for the three months ended March 31, 2023 were misstated by an immaterial amount and have been restated from the amounts previously reported to correct the classification of such revenues. There was no impact on our condensed consolidated statements of income, financial position, or cash flows.

The Company records unearned revenue when we have either received payment or contractually have the right to bill for services in advance of the services or performance obligations being performed. Unearned revenue recognized in the three months ended March 31, 2024 and 2023 was $61.9 million and $55.5 million, respectively. Changes in unearned revenue were as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | |

| (in thousands) | | | | | 2024 | | 2023 | | | | |

| Beginning balance | | | | | $ | 210,059 | | | $ | 187,994 | | | | | |

| Deferral of unearned revenue | | | | | 74,796 | | | 65,626 | | | | | |

| Recognition of unearned revenue | | | | | (61,888) | | | (55,466) | | | | | |

| Ending balance | | | | | $ | 222,967 | | | $ | 198,154 | | | | | |

As of March 31, 2024 and December 31, 2023, the Company had long-term unearned revenue of $36.9 million and $37.7 million, respectively, recorded in other long-term accrued liabilities. Unearned short-term revenue is recognized over the next 12-month period. The majority of unearned long-term revenue is recognized over a period of five years or less with immaterial amounts recognized through 2034.

Incremental Costs of Obtaining a Contract with a Customer

Incremental costs of obtaining a contract include only those costs that we incur to obtain a contract that we would not have incurred if the contract had not been obtained, primarily sales commissions. These costs are recorded as an asset and amortized to expense over the life of the contract to the extent such costs are expected to be recovered. As of March 31, 2024, we have $18.4 million of unamortized capitalized costs to obtain a contract, of which $15.4 million is recorded within other current assets and $3.0 million is recorded within other assets on our condensed consolidated statement of financial position. During the quarter ended March 31, 2024, we recorded approximately $3.8 million amortization of capitalized costs, which is recorded within sales, general and administrative expense on our condensed consolidated statement of income. During the quarter ended March 31, 2023, we had no unamortized capitalized costs to obtain a contract and we recorded no amortization of capitalized costs.

NOTE 5. ALLOWANCE FOR CREDIT LOSSES

The Company is exposed to credit losses primarily related to accounts receivables and financed receivables derived from customer services revenue. To reduce credit risk for residential pest control accounts receivable, we promote enrollment in our auto-pay programs. In general, we may suspend future services for customers with past due balances. The Company’s credit risk is generally low with a large number of individuals and entities comprising Rollins’ customer base and dispersion across many different geographical regions.

ROLLINS, INC. AND SUBSIDIARIES

The Company manages its financed receivables on an aggregate basis when assessing and monitoring credit risks. The Company’s established credit evaluation and monitoring procedures seek to minimize the amount of business we conduct with higher risk customers. The credit quality of a potential obligor is evaluated at the loan origination based on an assessment of the individual’s Beacon/credit bureau score. Rollins requires a potential obligor to have good credit worthiness with low risk before entering into a contract. Depending upon the individual’s credit score, the Company may accept with 100% financing, require a significant down payment or turn down the contract. Delinquencies of accounts are monitored each month. Financed receivables include installment receivable amounts, some of which are due subsequent to one year from the balance sheet dates.

The Company’s allowances for credit losses for trade accounts receivable and financed receivables are developed using historical collection experience, current economic and market conditions, reasonable and supportable forecasts, and a review of the current status of customers’ receivables. The Company’s receivable pools are classified between residential customers, commercial customers, large commercial customers, and financed receivables. Accounts are written off against the allowance for credit losses when the Company determines that amounts are uncollectible, and recoveries of amounts previously written off are recorded when collected. The Company stops accruing interest to these receivables when they are deemed uncollectible. Below is a roll forward of the Company’s allowance for credit losses for the three months ended March 31, 2024 and 2023.

| | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses |

| (in thousands) | Trade

Receivables | | Financed

Receivables | | Total

Receivables |

| Balance at December 31, 2023 | $ | 15,797 | | | $ | 5,602 | | | $ | 21,399 | |

| Provision for expected credit losses | 4,823 | | | 2,870 | | | 7,693 | |

| Write-offs charged against the allowance | (7,184) | | | (2,362) | | | (9,546) | |

| Recoveries collected | 1,429 | | | 146 | | | 1,575 | |

| Balance at March 31, 2024 | $ | 14,865 | | | $ | 6,256 | | | $ | 21,121 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses |

| (in thousands) | Trade

Receivables | | Financed

Receivables | | Total

Receivables |

| Balance at December 31, 2022 | $ | 14,073 | | | $ | 4,968 | | | $ | 19,041 | |

| Provision for expected credit losses | 1,461 | | | 2,435 | | | 3,896 | |

| Write-offs charged against the allowance | (4,687) | | | (1,927) | | | (6,614) | |

| Recoveries collected | 1,629 | | | — | | | 1,629 | |

| Balance at March 31, 2023 | $ | 12,476 | | | $ | 5,476 | | | $ | 17,952 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

NOTE 6. GOODWILL AND INTANGIBLE ASSETS

The following table summarizes changes in goodwill during the three months ended March 31, 2024 (in thousands):

| | | | | |

| Goodwill: | |

| Balance at December 31, 2023 | $ | 1,070,310 | |

| Additions | 27,337 | |

| |

| Adjustments due to currency translation and other | (2,506) | |

| Balance at March 31, 2024 | $ | 1,095,141 | |

ROLLINS, INC. AND SUBSIDIARIES

The following table sets forth the components of indefinite-lived and amortizable intangible assets as of March 31, 2024, and December 31, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 | | |

| Gross | | Accumulated

Amortization | | Carrying

Value | | Gross | | Accumulated

Amortization | | Carrying

Value | | Useful Life

in Years |

| Amortizable intangible assets: | | | | | | | | | | | | | |

| Customer contracts | $ | 645,021 | | | $ | (255,822) | | | $ | 389,199 | | | $ | 625,920 | | | $ | (239,768) | | | $ | 386,152 | | | 3-20 |

| Trademarks and tradenames | 22,413 | | | (10,324) | | | 12,089 | | | 21,566 | | | (9,933) | | | 11,633 | | | 7-20 |

| Other intangible assets | 25,376 | | | (19,233) | | | 6,143 | | | 24,766 | | | (18,779) | | | 5,987 | | | 3-20 |

| Total amortizable intangible assets | $ | 692,810 | | | $ | (285,379) | | | $ | 407,431 | | | $ | 672,252 | | | $ | (268,480) | | | 403,772 | | | |

| | | | | | | | | | | | | |

| Indefinite-lived intangible assets | | | | | 141,959 | | | | | | | 141,962 | | | |

| Total customer contracts and other intangible assets | | | | | $ | 549,390 | | | | | | | $ | 545,734 | | | |

Amortization expense related to intangible assets was $18.7 million and $14.0 million for the three months ended March 31, 2024 and 2023, respectively. Customer contracts and other amortizable intangible assets are amortized on a straight-line basis over their economic useful lives.

Estimated amortization expense for the existing carrying amount of customer contracts and other intangible assets for each of the five succeeding fiscal years as of March 31, 2024 are as follows:

| | | | | |

| (in thousands) | |

| 2024 (excluding the three months ended March 31, 2024) | $ | 61,384 | |

| 2025 | 72,147 | |

| 2026 | 68,042 | |

| 2027 | 64,176 | |

| 2028 | 62,165 | |

NOTE 7. FAIR VALUE MEASUREMENT

The Company’s financial instruments consist of cash and cash equivalents, trade receivables, financed and notes receivable, accounts payable, other short-term liabilities, and debt. The carrying amounts of these financial instruments approximate their respective fair values.

The fair value hierarchy has three levels based on the reliability of the inputs used to determine fair value. Level 1 refers to fair values determined based on quoted prices in active markets for identical assets. Level 2 refers to fair values estimated using significant other observable inputs, and Level 3 includes fair values estimated using significant non-observable inputs.

As of March 31, 2024 and December 31, 2023, we had investments in international bonds of $9.4 million and $10.2 million, respectively. These bonds are accounted for as available for sale securities and are level 2 assets under the fair value hierarchy. The bonds are recorded at their fair market values and reported within other current assets and other assets in our condensed consolidated statement of financial position. The unrealized gain or loss activity during the three months ended March 31, 2024 and 2023 was not significant.

ROLLINS, INC. AND SUBSIDIARIES

As of March 31, 2024 and December 31, 2023, the Company had $51.9 million and $46.1 million of acquisition holdback and earnout liabilities payable to former owners of acquired companies, respectively. The earnout liabilities were discounted to reflect the expected probability of payout, and both earnout and holdback liabilities were discounted to their net present value on the Company’s books and are considered level 3 liabilities. The table below presents a summary of the changes in fair value for these liabilities.

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| (in thousands) | | | | | 2024 | | 2023 |

| Beginning balance | | | | | $ | 46,104 | | | $ | 13,496 | |

| New acquisitions and revaluations | | | | | 6,664 | | | 1,300 | |

| Payouts | | | | | (1,474) | | | (4,098) | |

| Interest on outstanding contingencies | | | | | 534 | | | 22 | |

| Charge offset, forfeit and other | | | | | 30 | | | (187) | |

| Ending balance | | | | | $ | 51,858 | | | $ | 10,533 | |

NOTE 8. DEBT

On February 24, 2023, the Company entered into a revolving credit agreement (the "Credit Agreement") with, among others, JPMorgan Chase Bank, N.A. (“JPMorgan Chase”), as administrative agent (in such capacity, the “Administrative Agent”), which refinanced its previous credit facility described below.

The Credit Agreement provides for a $1.0 billion revolving credit facility (the “Credit Facility”), which may be denominated in U.S. Dollars and other currencies, including Euros, Australian Dollars, Canadian Dollars, New Zealand Dollars, Pounds Sterling and Japanese Yen, subject to a $400 million foreign currency sublimit. The Credit Facility also includes sub-facilities for the issuance of letters of credit of up to $150 million and swing line loans at the Administrative Agent’s discretion of up to $50 million. Certain subsidiaries of Rollins provide unsecured guarantees of the Credit Facility. Rollins has the ability to expand its borrowing availability under the Credit Agreement in the form of increased revolving commitments or one or more tranches of term loans by up to an additional $750 million, subject to the agreement of the participating lenders and certain other customary conditions. The maturity date of the loans under the Credit Agreement is February 24, 2028.

Loans under the Credit Agreement bear interest, at Rollins’ election, at (i) for loans denominated in U.S. Dollars, (A) an alternate base rate (subject to a floor of 0.00%), which is the greatest of (x) the prime rate publicly announced from time to time by JPMorgan Chase, (y) the greater of the federal funds effective rate and the Federal Reserve Bank of New York overnight bank funding rate, plus 50 basis points, and (z) Adjusted Term SOFR for a one month interest period, plus a margin ranging from 0.00% to 0.50% per annum based on Rollins’ consolidated total net leverage ratio; or (B) the greater of term SOFR for the applicable interest period plus 10 basis points (“Adjusted Term SOFR”) and zero, plus a margin ranging from 1.00% to 1.50% per annum based on Rollins’ consolidated total net leverage ratio; and (ii) for loans denominated in other currencies, including Euros, Australian Dollars, Canadian Dollars, New Zealand Dollars, Pounds Sterling and Japanese Yen, such interest rates as set forth in the Credit Agreement.

As of March 31, 2024, the Company had outstanding borrowings of $513.0 million under the Credit Facility. Borrowings under the Credit Facility are presented under the long-term debt caption of our condensed consolidated balance sheet, net of $2.1 million in unamortized debt issuance costs as of March 31, 2024. The aggregate effective interest rate on the debt outstanding as of March 31, 2024 was 6.4%. As of December 31, 2023, the Company had outstanding borrowings of $493.0 million under the Credit Facility. Borrowings under the Credit Facility are presented under the long-term debt caption of our condensed consolidated balance sheet, net of $2.2 million in unamortized debt issuance costs as of December 31, 2023. The aggregate effective interest rate on the debt outstanding as of December 31, 2023 was 6.5%.

The Company maintains $68.4 million in letters of credit as of March 31, 2024. These letters of credit are required by the Company’s insurance companies, due to the Company’s high deductible insurance program, to secure various workers’ compensation and casualty insurance contracts coverage and were decreased from $71.7 million as of December 31, 2023. The Company believes that it has adequate liquid assets, funding sources and insurance accruals to accommodate potential future insurance claims.

ROLLINS, INC. AND SUBSIDIARIES

The Credit Agreement contains customary terms and conditions, including, without limitation, certain financial covenants including covenants restricting Rollins’ ability to incur certain indebtedness or liens, or to merge or consolidate with or sell substantially all of its assets to another entity. Further, the Credit Agreement contains a financial covenant restricting Rollins’ ability to permit the ratio of Rollins’ consolidated total net debt to EBITDA to exceed 3.50 to 1.00. Following certain acquisitions, Rollins may elect to increase the financial covenant level to 4.00 to 1.00 temporarily. The ratio is calculated as of the last day of the fiscal quarter most recently ended. The Credit Agreement also contains provisions permitting a future environmental, social and governance amendment, subject to certain terms and conditions contained therein, by which pricing may be adjusted pursuant to the Company's performance measured against certain sustainability-linked metrics. The Company is in compliance with applicable debt covenants as of March 31, 2024.

NOTE 9. CONTINGENCIES

In the normal course of business, the Company and its subsidiaries are involved in, and will continue to be involved in, various claims, arbitrations, contractual disputes, investigations, and regulatory and litigation matters relating to, and arising out of, our businesses and our operations. These matters may involve, but are not limited to, allegations that our services or vehicles caused damage or injury, claims that our services did not achieve the desired results, claims related to acquisitions and allegations by federal, state or local authorities, including taxing authorities, of violations of regulations or statutes. In addition, we are parties to employment-related cases and claims from time to time, which may include claims on a representative or class action basis alleging wage and hour law violations. We are also involved from time to time in certain environmental matters primarily arising in the normal course of business. We evaluate pending and threatened claims and establish loss contingency reserves based upon outcomes we currently believe to be probable and reasonably estimable.

The Company retains, up to specified limits, certain risks related to general liability, workers’ compensation and auto liability. The estimated costs of existing and future claims under the retained loss program are accrued based upon historical trends as incidents occur, whether reported or unreported (although actual settlement of the claims may not be made until future periods) and may be subsequently revised based on developments relating to such claims. The Company contracts with an independent third party to provide the Company an estimated liability based upon historical claims information. The actuarial study is a major consideration in establishing the reserve, along with management’s knowledge of changes in business practice and existing claims compared to current balances. Management’s judgment is inherently subjective as a number of factors are outside management’s knowledge and control. Additionally, historical information is not always an accurate indication of future events. The accruals and reserves we hold are based on estimates that involve a degree of judgment and are inherently variable and could be overestimated or insufficient. If actual claims exceed our estimates, our operating results could be materially affected, and our ability to take timely corrective actions to limit future costs may be limited.

Management does not believe that any pending claim, proceeding or litigation, regulatory action or investigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial position, results of operations or liquidity; however, it is possible that an unfavorable outcome of some or all of the matters could result in a charge that might be material to the results of an individual quarter or year.

NOTE 10. STOCKHOLDERS' EQUITY

During the three months ended March 31, 2024, the Company paid $72.6 million, or $0.15 per share, in cash dividends compared to $64.1 million, or $0.13 per share, during the same period in 2023.

The Company withholds shares from employees for the payment of their taxes on equity awards that have vested. The Company withheld $11.3 million and $9.8 million in connection with employee tax obligations during the three month periods ended March 31, 2024 and 2023, respectively. The Company did not repurchase shares on the open market during the three months ended March 31, 2024 and March 31, 2023.

ROLLINS, INC. AND SUBSIDIARIES

The following table summarizes the components of the Company’s stock-based compensation programs recorded as expense:

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| (in thousands) | | | | | 2024 | | 2023 |

| Restricted shares and PSUs: | | | | | | | |

| Compensation expense | | | | | $ | 6,607 | | | $ | 5,755 | |

Employee Stock Purchase Plan

As more fully discussed in Note 13 of the Company’s notes to the consolidated financial statements in its 2023 Annual Report on Form 10-K, shareholders approved the Rollins, Inc. 2022 Employee Stock Purchase Plan which provides eligible employees with the option to purchase shares of Company common stock, at a discount, through payroll deductions during six-month offering periods. The most recent purchase period for the ESPP began on January 1, 2024, and will end on June 30, 2024. The Company recorded compensation expense associated with its ESPP of $0.6 million during the three months ended March 31, 2024. Compensation expense for the ESPP is included in cost of services provided and sales, general and administrative expenses in our condensed consolidated statements of income.

NOTE 11. EARNINGS PER SHARE

The Company reports both basic and diluted earnings per share. Basic earnings per share is computed by dividing net income available to participating common stockholders by the weighted average number of participating common shares outstanding for the period. Diluted earnings per share is calculated by dividing the net income available to participating common shareholders by the diluted weighted average number of shares outstanding for the period. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive equity.

A reconciliation of weighted average shares outstanding is as follows (in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2024 | | 2023 |

| | | | | | | |

| Weighted-average outstanding common shares | | | | | 481,877 | | 490,209 |

| Add participating securities: | | | | | | | |

| Weighted-average time-lapse restricted awards | | | | | 2,254 | | 2,307 |

| Total weighted-average shares outstanding – basic | | | | | 484,131 | | 492,516 |

| Dilutive effect of restricted stock units and PSUs | | | | | 187 | | 185 |

| Weighted-average shares outstanding – diluted | | | | | 484,318 | | 492,701 |

NOTE 12. INCOME TAXES

The Company’s provision for income taxes is recorded on an interim basis based upon the Company’s estimate of the annual effective income tax rate for the full year applied to “ordinary” income or loss, adjusted each quarter for discrete items. The Company recorded a provision for income taxes of $30.2 million and $28.3 million for the three months ended March 31, 2024 and 2023, respectively.

The Company’s effective tax rate was 24.3% in the first quarter of 2024, consistent with the 24.3% rate in the first quarter of 2023.

NOTE 13. SUBSEQUENT EVENTS

Quarterly Dividend

On April 23, 2024, the Company’s Board of Directors declared a regular quarterly cash dividend on its common stock of $0.15 per share payable on June 10, 2024 to stockholders of record at the close of business on May 10, 2024.

ROLLINS, INC. AND SUBSIDIARIES

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report on Form 10-Q.

GENERAL OPERATING COMMENTS

Below is a summary of the key operating results for the three months ended March 31, 2024:

•First quarter revenues were $748.3 million, an increase of 13.7% over the first quarter 2023 with organic revenues* increasing 7.5%.

•Quarterly operating income was $132.4 million, an increase of 18.0% over the first quarter of 2023. Quarterly operating margin was 17.7% of revenue, an increase of 60 basis points over the first quarter of 2023. Adjusted operating income* was $137.7 million, an increase of 22.7% over the prior year. Adjusted operating income margin* was 18.4%, an increase of 130 basis points over the prior year. Adjusted EBITDA* was $160.8 million, an increase of 19.3%. Adjusted EBITDA margin* was 21.5% of revenue, an increase of 100 basis points over the first quarter of 2023.

•Quarterly net income was $94.4 million, an increase of 7.0% over the prior year net income. Adjusted net income* was $98.4 million, an increase of 16.1% over the prior year.

•Quarterly EPS was $0.19 per diluted share, a 5.6% increase over the prior year EPS of $0.18. Adjusted EPS* was $0.20 per diluted share, an increase of 17.6% over the prior year.

•Operating cash flow was $127.4 million for the quarter, an increase of 26.5% over the prior year. The Company invested $47.1 million in acquisitions, $7.2 million in capital expenditures, and paid dividends totaling $72.6 million.

Demand remains favorable to start the second quarter and the pipeline of acquisition activity remains healthy. Although we continue to navigate a highly uncertain macro-environment, we believe we are well positioned to deliver strong results in 2024.

We remain focused on driving 7% to 8% organic growth while adding 2% to 3% of inorganic growth for 2024. While we believe this goal is achievable, we acknowledge the potential impact weather as well as volatility in one-time business, and staffing levels, amongst other factors, might have on revenue performance. We continue to focus on improving the efficiency of our business model while investing in programs aimed at growing our business across our service offerings.

*Amounts are non-GAAP financial measures. See the schedules below for a discussion of non-GAAP financial metrics including a reconciliation of the most directly comparable GAAP measure.

IMPACT OF ECONOMIC TRENDS

The continued disruption in economic markets due to high inflation, increases in interest rates, business interruptions due to natural disasters and changes in weather patterns, employee shortages, and supply chain issues, all pose challenges which may adversely affect our future performance. The Company continues to execute various strategies previously implemented to help mitigate the impact of these economic disruptors.

However, the Company cannot reasonably estimate whether these strategies will help mitigate the impact of these economic disruptors in the future.

The Company’s condensed consolidated financial statements reflect estimates and assumptions made by management that affect the reported amounts of assets and liabilities and related disclosures as of the date of the condensed consolidated financial statements. The Company considered the impact of economic trends on the assumptions and estimates used in preparing the condensed consolidated financial statements. In the opinion of management, all material adjustments necessary for a fair presentation of the Company’s financial results for the quarter have been made. These adjustments are of a normal recurring nature but are complicated by the continued uncertainty surrounding these macro economic trends. The severity, magnitude and duration of certain economic trends continue to be uncertain and are difficult to predict.

ROLLINS, INC. AND SUBSIDIARIES

Therefore, our accounting estimates and assumptions may change over time in response to economic trends and may change materially in future periods.

The extent to which increasing interest rates, inflation and other economic trends will continue to impact the Company’s business, financial condition and results of operations is uncertain. Therefore, we cannot reasonably estimate the full future impacts of these matters at this time.

Tax Legislation Developments

The Organization for Economic Co-operation and Development ("OECD") has proposed a global minimum tax of 15% of reported profits ("Pillar Two") for multinational enterprises with annual global revenues exceeding €750 million. Pillar Two has been agreed upon in principle by over 140 countries and is intended to apply for tax years beginning in 2024. The OECD has issued administrative guidance (including transitional safe harbor rules) in conjunction with the implementation of the Pillar Two global minimum tax. The Company has evaluated the impact of these rules and currently believes they will not have any material impact on financial results in 2024 due to certain transitional safe harbors. The Company will continue to monitor the potential impact of Pillar Two proposals and developments on our condensed consolidated financial statements and related disclosures as various tax jurisdictions begin enacting such legislation.

RESULTS OF OPERATIONS

Quarter ended March 31, 2024 compared to quarter ended March 31, 2023

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| | | | | Variance |

| (in thousands, except per share data) | 2024 | | 2023 | | $ | % |

| GAAP Metrics | | | | | | |

| Revenues | $ | 748,349 | | | $ | 658,015 | | | $ | 90,334 | | 13.7 | % |

Gross profit (1) | $ | 382,791 | | | $ | 331,173 | | | $ | 51,618 | | 15.6 | % |

Gross profit margin (1) | 51.2 | % | | 50.3 | % | | | 90 bps |

| Operating income | $ | 132,424 | | | $ | 112,240 | | | $ | 20,184 | | 18.0 | % |

| Operating income margin | 17.7 | % | | 17.1 | % | | | 60 bps |

| Net income | $ | 94,394 | | | $ | 88,234 | | | $ | 6,160 | | 7.0 | % |

| EPS | $ | 0.19 | | | $ | 0.18 | | | $ | 0.01 | | 5.6 | % |

| Operating cash flow | $ | 127,433 | | | $ | 100,773 | | | 26,660 | | 26.5 | % |

| | | | | | |

| Non-GAAP Metrics | | | | | | |

Adjusted operating income (2) | $ | 137,689 | | | $ | 112,240 | | | $ | 25,449 | | 22.7 | % |

Adjusted operating margin (2) | 18.4 | % | | 17.1 | % | | | 130 bps |

Adjusted net income (2) | $ | 98,357 | | | $ | 84,727 | | | $ | 13,630 | | 16.1 | % |

Adjusted EPS (2) | $ | 0.20 | | | $ | 0.17 | | | $ | 0.03 | | 17.6 | % |

Adjusted EBITDA (2) | $ | 160,783 | | | $ | 134,742 | | | $ | 26,041 | | 19.3 | % |

Adjusted EBITDA margin (2) | 21.5 | % | | 20.5 | % | | | 100 bps |

Free cash flow (2) | $ | 120,262 | | | $ | 93,137 | | | $ | 27,125 | | 29.1 | % |

(1) Exclusive of depreciation and amortization

(2) Amounts are non-GAAP financial measures. See "Non-GAAP Financial Measures" of this Form 10-Q for a discussion of non-GAAP financial metrics including a reconciliation of the most directly comparable GAAP measure.

ROLLINS, INC. AND SUBSIDIARIES

Revenues

The following presents a summary of revenues by product and service offering and revenues by geography:

Revenues for the quarter ended March 31, 2024 were $748.3 million, an increase of $90.3 million, or 13.7%, from 2023 revenues of $658.0 million. The increase in revenues was driven by demand from our customers across all major service offerings. Organic revenue* growth was 7.5% with acquisitions adding 7.0% in the quarter. Residential pest control revenue increased approximately 16%, commercial pest control revenue increased approximately 11% and termite and ancillary services grew approximately 12% including both organic and acquisition-related growth in each area. Organic revenue* growth was strong across our service offerings, growing over 4% in residential, 10% in commercial, and over 9% in termite and ancillary activity.

After a slow start to the quarter, we saw a general strengthening in demand in February and March. Overall organic revenue* growth was 7.5% for the quarter and was 10.8% across February and March. We saw strengthening in substantially all major service offerings as we moved throughout the quarter. January revenue weakness was driven primarily by unfavorable weather patterns.

ROLLINS, INC. AND SUBSIDIARIES

Revenues are impacted by the seasonal nature of the Company’s pest and termite control services. The increase in pest activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the change in seasons), has historically resulted in an increase in the Company’s revenues as evidenced by the following chart:

| | | | | | | | | | | | | | | | | |

| Consolidated Net Revenues |

| (in thousands) | 2024 | | 2023 | | 2022 |

| First Quarter | $ | 748,349 | | | $ | 658,015 | | | $ | 590,680 | |

| Second Quarter | — | | | 820,750 | | | 714,049 | |

| Third Quarter | — | | | 840,427 | | | 729,704 | |

| Fourth Quarter | — | | | 754,086 | | | 661,390 | |

| Year to date | $ | 748,349 | | | $ | 3,073,278 | | | $ | 2,695,823 | |

Gross Profit (exclusive of Depreciation and Amortization)

Gross profit for the quarter ended March 31, 2024 was $382.8 million, an increase of $51.6 million, or 15.6%, compared to $331.2 million for the quarter ended March 31, 2023. Gross margin improved 90 basis points to 51.2% in 2024 compared to 50.3% in 2023. The recent acquisition of FPC Holdings, LLC (“Fox Pest Control”, or "Fox") was accretive to gross margin by 40 basis points. Excluding Fox, we saw 50 basis points of improvement in underlying margins, as pricing more than offset inflationary pressures. We saw leverage on people costs, fleet, and materials and supplies, the major areas that comprise cost of services provided.

Sales, General and Administrative

For the quarter ended March 31, 2024, sales, general and administrative ("SG&A") expenses increased $26.6 million, or 13.6%, compared to the quarter ended March 31, 2023. The increase is driven by expenses associated with growth initiatives aimed at capitalizing on the health of our underlying markets, offset by leverage from administrative costs.

As a percentage of revenue, SG&A decreased to 29.8% from 29.9% in the prior year, as we continue to manage our cost structure while investing in growth initiatives. Adjusted SG&A*, which eliminates the impact of certain costs associated with acquisitions, was 29.7%. Looking more closely at SG&A, we saw improvement of approximately 70 basis points associated with lower administrative costs. A majority of these savings, approximately 50 basis points, were reinvested back into growth initiatives aimed at driving improved revenue growth.

Depreciation and Amortization

For the quarter ended March 31, 2024, depreciation and amortization increased $4.8 million, or 21.4%, compared to the quarter ended March 31, 2023. The increase was due to higher amortization of intangible assets from acquisitions, most notably from Fox.

Operating Income

For the quarter ended March 31, 2024, operating income increased $20.2 million, or 18.0%, compared to the prior year.

As a percentage of revenue, operating income was 17.7%, an increase of 60 basis points over the first quarter of 2023. Operating margin improved on the changes noted in gross profit and SG&A above, offset by higher depreciation and amortization associated with our acquisition of Fox.

Interest Expense, Net

During the quarter ended March 31, 2024, interest expense, net increased $7.3 million compared to the prior year, primarily due to the higher average debt balance, as well as the increase in weighted average interest rates in the first quarter of 2024 compared to the first quarter of 2023. The increase was driven by the debt associated with the acquisition of Fox in the second quarter of 2023 and the share repurchase completed in the third quarter of 2023.

ROLLINS, INC. AND SUBSIDIARIES

Other Income, Net

During the quarter ended March 31, 2024, other income decreased $4.8 million primarily due to lower gains on non-operational asset sales.

Income Taxes

The Company’s effective tax rate was 24.3% in the first quarter of 2024, and was in line with the same rate for the first quarter of 2023.

Non-GAAP Financial Measures

Reconciliation of GAAP and non-GAAP Financial Measures

The Company has used the non-GAAP financial measures of organic revenues, organic revenues by type, adjusted operating income, adjusted operating margin, adjusted net income, adjusted earnings per share (“EPS”), earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA margin, Adjusted EBITDA, adjusted EBITDA margin, incremental EBITDA margin, adjusted incremental EBITDA margin, free cash flow, free cash flow conversion, net debt, net leverage ratio, and adjusted sales, general and administrative expenses ("Adjusted SG&A") in this Form 10-Q. Organic revenue is calculated as revenue less the revenue from acquisitions completed within the prior 12 months and excluding the revenue from divested businesses. Acquisition revenue is based on the trailing 12-month revenue of our acquired entities. Adjusted operating income and adjusted operating income margin are calculated by adding back to the GAAP measures those expenses resulting from the amortization of certain intangible assets and adjustments to the fair value of contingent consideration resulting from the acquisition of Fox. Adjusted net income and adjusted EPS are calculated by adding back to the GAAP measure amortization of certain intangible assets and adjustments to the fair value of contingent consideration resulting from the acquisition of Fox and excluding gains and losses on the sale of non-operational assets and by further subtracting the tax impact of those expenses, gains, or losses. Adjusted EBITDA and adjusted EBITDA margin are calculated by adding back to the GAAP measures those expenses resulting from the adjustments to the fair value of contingent consideration resulting from the acquisition of Fox and excluding gains and losses on the sale of non-operational assets. Incremental margin is calculated as the change in EBITDA divided by the change in revenue. Adjusted incremental margin is calculated as the change in adjusted EBITDA divided by the change in revenue. Free cash flow is calculated by subtracting capital expenditures from cash provided by operating activities. Free cash flow conversion is calculated as free cash flow divided by net income. Net debt is calculated as total long-term debt less cash and cash equivalents. Net leverage ratio is calculated by dividing net debt by trailing twelve-month EBITDA. Adjusted SG&A is calculated by removing the adjustments to the fair value of contingent consideration resulting from the acquisition of Fox. These measures should not be considered in isolation or as a substitute for revenues, net income, earnings per share or other performance measures prepared in accordance with GAAP.

Management uses adjusted operating income, adjusted operating income margin, adjusted net income, adjusted EPS, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, incremental EBITDA margin, adjusted incremental EBITDA margin, and adjusted SG&A as measures of operating performance because these measures allow the Company to compare performance consistently over various periods. Management also uses organic revenues, and organic revenues by type to compare revenues over various periods excluding the impact of acquisitions and divestitures. Management uses free cash flow to demonstrate the Company’s ability to maintain its asset base and generate future cash flows from operations. Management uses free cash flow conversion to demonstrate how much net income is converted into cash. Management uses net debt as an assessment of overall liquidity, financial flexibility, and leverage. Net leverage ratio is useful to investors because it is an indicator of our ability to meet our future financial obligations. Management believes all of these non-GAAP financial measures are useful to provide investors with information about current trends in, and period-over-period comparisons of, the Company's results of operations. An analysis of any non-GAAP financial measure should be used in conjunction with results presented in accordance with GAAP.

A non-GAAP financial measure is a numerical measure of financial performance, financial position, or cash flows that either 1) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of operations, balance sheet or statement of cash flows, or 2) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

Set forth below is a reconciliation of the non-GAAP financial measures contained in this report with their most directly comparable GAAP measures (unaudited, in thousands, except per share data and margins).

ROLLINS, INC. AND SUBSIDIARIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended March 31, | | Variance |

| | | | | | | | | 2024 | | 2023 | | $ | | % |

| Reconciliation of Revenues to Organic Revenues |

| Revenues | | | | | | | | | $ | 748,349 | | | $ | 658,015 | | | 90,334 | | | 13.7 |

| Revenues from acquisitions | | | | | | | | | (45,987) | | | — | | | (45,987) | | | 7.0 |

| Revenues of divestitures | | | | | | | | | — | | | (4,753) | | | 4,753 | | | (0.8) |

| Organic revenues | | | | | | | | | $ | 702,362 | | | $ | 653,262 | | | 49,100 | | | 7.5 |

| | | | | | | | | | | | | | | |

| Reconciliation of Operating Income to Adjusted Operating Income and Adjusted Operating Income Margin |

| Operating income | | | | | | | | | $ | 132,424 | | | $ | 112,240 | | | | | |

Fox acquisition-related expenses (1) | | | | | | | | | 5,265 | | | — | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted operating income | | | | | | | | | $ | 137,689 | | | $ | 112,240 | | | 25,449 | | | 22.7 |

| Revenues | | | | | | | | | $ | 748,349 | | | $ | 658,015 | | | | | |

| Operating income margin | | | | | | | | | 17.7 | % | | 17.1 | % | | | | |

| Adjusted operating margin | | | | | | | | | 18.4 | % | | 17.1 | % | | | | |

| | | | | | | | | | | | | | | |

Reconciliation of Net Income to Adjusted Net Income and Adjusted EPS (5) |

| Net income | | | | | | | | | $ | 94,394 | | | $ | 88,234 | | | | | |

Fox acquisition-related expenses (1) | | | | | | | | | 5,265 | | | — | | | | | |

Loss (gain) on sale of assets, net (2) | | | | | | | | | 61 | | | (4,714) | | | | | |

Tax impact of adjustments (3) | | | | | | | | | (1,363) | | | 1,207 | | | | | |

| Adjusted net income | | | | | | | | | $ | 98,357 | | | $ | 84,727 | | | 13,630 | | | 16.1 |

| EPS - basic and diluted | | | | | | | | | $ | 0.19 | | | $ | 0.18 | | | | | |

Fox acquisition-related expenses (1) | | | | | | | | | 0.01 | | | — | | | | | |

Loss (gain) on sale of assets, net (2) | | | | | | | | | — | | | (0.01) | | | | | |

Tax impact of adjustments (3) | | | | | | | | | — | | | — | | | | | |

Adjusted EPS - basic and diluted (4) | | | | | | | | | $ | 0.20 | | | $ | 0.17 | | | 0.03 | | | 17.6 |

| Weighted average shares outstanding – basic | | | | | | | | | 484,131 | | | 492,516 | | | | | |

| Weighted average shares outstanding – diluted | | | | | | | | | 484,318 | | | 492,701 | | | | | |

| | | | | | | | | | | | | | | |

Reconciliation of Net Income to EBITDA, Adjusted EBITDA, EBITDA Margin, Incremental EBITDA Margin, Adjusted EBITDA Margin, and Adjusted Incremental EBITDA Margin (5) |

| Net income | | | | | | | | | $ | 94,394 | | | $ | 88,234 | | | | | |

| Depreciation and amortization | | | | | | | | | 27,310 | | | 22,502 | | | | | |

| Interest expense, net | | | | | | | | | 7,725 | | | 465 | | | | | |

| Provision for income taxes | | | | | | | | | 30,244 | | | 28,255 | | | | | |

| EBITDA | | | | | | | | | $ | 159,673 | | | $ | 139,456 | | | 20,217 | | | 14.5 |

Fox acquisition-related expenses (1) | | | | | | | | | 1,049 | | | — | | | | | |

Loss (gain) on sale of assets, net (2) | | | | | | | | | 61 | | | (4,714) | | | | | |

| Adjusted EBITDA | | | | | | | | | $ | 160,783 | | | $ | 134,742 | | | 26,041 | | | 19.3 |

| Revenues | | | | | | | | | $ | 748,349 | | | $ | 658,015 | | | | | |

| EBITDA margin | | | | | | | | | 21.3 | % | | 21.2 | % | | | | |