10-Q: Quarterly report [Sections 13 or 15(d)]

Published on April 24, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 10-Q

For the quarterly period ended March 31, 2025

OR

For the transition period from to

Commission File Number 1-4422

| ||

|

(Exact name of registrant as specified in its charter)

| ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices)

(Zip Code)

(404 ) 888-2000

(Registrant’s telephone number, including area code)

___________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | o | ||||||||||||

| Non-accelerated filer | o | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

Rollins, Inc. had 484,646,456 shares of its $1 par value Common Stock outstanding as of April 14, 2025.

ROLLINS, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

| Pages | ||||||||

2

ROLLINS, INC. AND SUBSIDIARIES

PART 1 FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF MARCH 31, 2025 AND DECEMBER 31, 2024

(in thousands except share data)

(unaudited)

| March 31, 2025 |

December 31, 2024 |

||||||||||

| ASSETS | |||||||||||

| Cash and cash equivalents | $ |

|

$ | ||||||||

Trade receivables, net of allowance for expected credit losses of $ |

|

||||||||||

Financed receivables, short-term, net of allowance for expected credit losses of $ |

|

||||||||||

| Materials and supplies |

|

||||||||||

| Other current assets |

|

||||||||||

| Total current assets |

|

||||||||||

Equipment and property, net of accumulated depreciation of $ |

|

||||||||||

| Goodwill |

|

||||||||||

| Customer contracts, net |

|

||||||||||

| Trademarks & tradenames, net |

|

||||||||||

| Other intangible assets, net |

|

||||||||||

| Operating lease right-of-use assets |

|

||||||||||

Financed receivables, long-term, net of allowance for expected credit losses of $ |

|

||||||||||

| Other assets |

|

||||||||||

| Total assets | $ |

|

$ | ||||||||

| LIABILITIES | |||||||||||

| Accounts payable | $ |

|

$ | ||||||||

| Accrued insurance - current |

|

||||||||||

| Accrued compensation and related liabilities |

|

||||||||||

| Unearned revenues |

|

||||||||||

| Operating lease liabilities - current |

|

||||||||||

| Other current liabilities |

|

||||||||||

| Total current liabilities |

|

||||||||||

| Accrued insurance, less current portion |

|

||||||||||

| Operating lease liabilities, less current portion |

|

||||||||||

| Long-term debt |

|

||||||||||

| Other long-term accrued liabilities |

|

||||||||||

| Total liabilities |

|

||||||||||

| Commitments and contingencies (see Note 9) | |||||||||||

| STOCKHOLDERS’ EQUITY | |||||||||||

Preferred stock, without par value; |

|

||||||||||

Common stock, par value $ |

|

||||||||||

| Additional paid in capital |

|

||||||||||

| Accumulated other comprehensive loss | ( |

( |

|||||||||

| Retained earnings |

|

||||||||||

| Total stockholders’ equity |

|

||||||||||

| Total liabilities and stockholders’ equity | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(in thousands except per share data)

(unaudited)

| Three Months Ended March 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| REVENUES | |||||||||||

| $ |

|

$ | |||||||||

| COSTS AND EXPENSES | |||||||||||

| Cost of services provided (exclusive of depreciation and amortization below) |

|

||||||||||

| Sales, general and administrative |

|

||||||||||

| Depreciation and amortization |

|

||||||||||

| Total operating expenses |

|

||||||||||

| OPERATING INCOME |

|

||||||||||

| Interest expense, net |

|

||||||||||

| Other (income) expense, net | ( |

||||||||||

| CONSOLIDATED INCOME BEFORE INCOME TAXES |

|

||||||||||

| PROVISION FOR INCOME TAXES |

|

||||||||||

| NET INCOME | $ |

|

$ | ||||||||

| NET INCOME PER SHARE - BASIC AND DILUTED | $ |

|

$ | ||||||||

| Weighted average shares outstanding – basic | |||||||||||

| Weighted average shares outstanding – diluted | |||||||||||

| DIVIDENDS PAID PER SHARE | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(in thousands)

(unaudited)

| Three Months Ending March 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| NET INCOME | $ |

|

$ | ||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||

| Foreign currency translation adjustments |

|

( |

|||||||||

| Pension settlement |

|

||||||||||

| Unrealized (loss) gain on available for sale securities | ( |

||||||||||

| Other comprehensive income (loss), net of tax |

|

( |

|||||||||

| Comprehensive income | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(in thousands)

(unaudited)

| Common Stock | Additional Paid-in Capital |

Accumulated Other Comprehensive Income / (Loss) |

Retained Earnings |

Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at December 31, 2024 | $ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||

| Net Income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax: | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | |||||||||||||||||||||||||||||||

| Pension settlement | — | — | — | — | |||||||||||||||||||||||||||||||

| Unrealized loss on available for sale securities | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||

| Cash dividends | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||

| Stock compensation | — | — | |||||||||||||||||||||||||||||||||

| Shares withheld for payment of employee taxes | ( |

( |

( |

— | — | ( |

|||||||||||||||||||||||||||||

| Balance at March 31, 2025 | $ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital |

Accumulated Other Comprehensive Income / (Loss) |

Retained Earnings |

Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||

| Net Income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other comprehensive (loss) income, net of tax: | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||

| Unrealized gain on available for sale securities | — | — | — | — | |||||||||||||||||||||||||||||||

| Cash dividends | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||

| Stock compensation | — | — | |||||||||||||||||||||||||||||||||

| Shares withheld for payment of employee taxes | ( |

( |

( |

— | — | ( |

|||||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

ROLLINS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(in thousands)

(unaudited)

| Three Months Ended March 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net income | $ |

|

$ | ||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization |

|

||||||||||

| Stock-based compensation expense |

|

||||||||||

| Provision for expected credit losses |

|

||||||||||

| Gain on sale of assets, net | ( |

( |

|||||||||

| Provision for deferred income taxes |

|

||||||||||

| Other operating activities, net |

|

||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Trade accounts receivable | ( |

( |

|||||||||

| Financing receivables | ( |

( |

|||||||||

| Materials and supplies | ( |

( |

|||||||||

| Other current assets | ( |

( |

|||||||||

| Accounts payable and accrued expenses | ( |

( |

|||||||||

| Unearned revenue |

|

||||||||||

| Other long-term assets and liabilities |

|

||||||||||

| Net cash provided by operating activities |

|

||||||||||

| INVESTING ACTIVITIES | |||||||||||

| Acquisitions, net of cash acquired | ( |

( |

|||||||||

| Capital expenditures | ( |

( |

|||||||||

| Proceeds from sale of assets |

|

||||||||||

| Other investing activities, net |

|

||||||||||

| Net cash used in investing activities | ( |

( |

|||||||||

| FINANCING ACTIVITIES | |||||||||||

| Payment of contingent consideration | ( |

( |

|||||||||

| Issuance of senior notes |

|

||||||||||

| Borrowings under revolving commitment |

|

||||||||||

| Repayments of revolving commitment | ( |

( |

|||||||||

| Payment of debt issuance costs | ( |

||||||||||

| Payment of dividends | ( |

( |

|||||||||

| Cash paid for common stock purchased | ( |

( |

|||||||||

| Other financing activities, net |

|

||||||||||

| Net cash used in financing activities | ( |

( |

|||||||||

| Effect of exchange rate changes on cash |

|

( |

|||||||||

| Net increase in cash and cash equivalents |

|

||||||||||

| Cash and cash equivalents at beginning of period |

|

||||||||||

| Cash and cash equivalents at end of period | $ |

|

$ | ||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Cash paid for interest | $ |

|

$ | ||||||||

| Cash paid for income taxes, net | $ |

|

$ | ||||||||

| Non-cash additions to operating lease right-of-use assets | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

ROLLINS, INC. AND SUBSIDIARIES

NOTE 1. BASIS OF PREPARATION

Basis of Preparation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP, the instructions to Form 10-Q and applicable sections of Securities and Exchange Commission ("SEC") regulation S-X, and therefore do not include all information and footnotes required by U.S. GAAP for complete financial statements. There have been no material changes in the Company’s significant accounting policies or the information disclosed in the notes to the consolidated financial statements included in the Annual Report on Form 10-K of Rollins, Inc. (including its subsidiaries unless the context otherwise requires, “Rollins,” “we,” “us,” “our,” or the “Company”) for the year ended December 31, 2024. Accordingly, the quarterly condensed consolidated financial statements and related disclosures herein should be read in conjunction with the 2024 Annual Report on Form 10-K.

The Company’s condensed consolidated financial statements reflect estimates and assumptions made by management that affect the reported amounts of assets and liabilities and related disclosures as of the date of the condensed consolidated financial statements. The Company considered the impact of economic trends on the assumptions and estimates used in preparing the condensed consolidated financial statements. In the opinion of management, all material adjustments necessary for a fair presentation of the Company’s financial results for the quarter have been made. These adjustments are of a normal recurring nature but complicated by the continued uncertainty surrounding economic trends. The results of operations for the three months ended March 31, 2025 are not necessarily indicative of results for the entire year. The severity, magnitude and duration of certain economic trends continue to be uncertain and are difficult to predict. Therefore, our accounting estimates and assumptions may change over time in response to economic trends and may change materially in future periods.

NOTE 2. RECENT ACCOUNTING PRONOUNCEMENTS

Accounting standards issued but not yet adopted

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures” (“ASU 2023-09”), which is intended to enhance the transparency and decision usefulness of income tax disclosures. This amendment modifies the rules on income tax disclosures to require entities to disclose (1) specific categories in the rate reconciliation and additional information for reconciling items that meet a quantitative threshold, (2) the amount of income taxes paid (net of refunds received) (disaggregated by federal, state, and foreign taxes) as well as individual jurisdictions in which income taxes paid is equal to or greater than 5 percent of total income taxes paid net of refunds, (3) the income or loss from continuing operations before income tax expense or benefit (disaggregated between domestic and foreign) and (4) income tax expense or benefit from continuing operations (disaggregated by federal, state and foreign). The guidance is effective for annual periods beginning after December 15, 2024, with early adoption permitted for annual financial statements that have not yet been issued or made available for issuance. ASU 2023-09 should be applied on a prospective basis, while retrospective application is permitted. The Company is currently evaluating the potential impact of adopting this new ASU on its disclosures.

In November 2024, the FASB issued ASU 2024-03, "Disaggregation of Income Statement Expenses (DISE)", which requires additional disclosure of the nature of expenses included in the income statement in response to longstanding requests from investors for more information about an entity’s expenses. The new standard requires disclosures about specific types of expenses included in the expense captions presented on the face of the income statement as well as disclosures about selling expenses. The guidance will be effective for annual reporting periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027. The requirements will be applied prospectively with the option for retrospective application. Early adoption is permitted. The Company is currently evaluating the impact that the adoption of this ASU will have on its consolidated financial statements and related disclosures.

8

ROLLINS, INC. AND SUBSIDIARIES

NOTE 3. ACQUISITIONS

2025 Acquisitions

The Company made 4 acquisitions during the three months ended March 31, 2025. The aggregate preliminary values of major classes of assets acquired and liabilities assumed recorded at the dates of acquisition are included in the reconciliation of the total preliminary consideration as follows (in thousands):

| March 31, 2025 | |||||

| Cash | $ |

|

|||

| Accounts receivable |

|

||||

| Materials and supplies |

|

||||

| Other current assets |

|

||||

| Equipment and property |

|

||||

| Goodwill |

|

||||

| Customer contracts |

|

||||

| Trademarks & tradenames |

|

||||

| Other intangible assets |

|

||||

| Current liabilities | ( |

||||

| Unearned revenue | ( |

||||

| Other assets and liabilities, net | ( |

||||

| Assets acquired and liabilities assumed | $ |

|

|||

Included in the total consideration of $28.9 million are acquisition holdback liabilities of $4.7 million.

The Company also made payments of $3.1 million for prior year acquisitions during the three months ended March 31, 2025.

Goodwill from acquisitions represents the excess of the purchase price over the fair value of net assets of businesses acquired. The factors contributing to the amount of goodwill are based on strategic and synergistic benefits that are expected to be realized. A majority of the recognized goodwill is expected to be deductible for tax purposes. Valuations of certain assets and liabilities, including intangible assets and goodwill, as of the acquisition date have not been finalized at this time and are provisional.

NOTE 4. REVENUE

Revenue, classified by the major geographic areas in which our customers are located, was as follows:

| Three Months Ended March 31, |

|||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| United States | $ |

|

$ | ||||||||

| Other countries |

|

||||||||||

| Total Revenues | $ |

|

$ | ||||||||

9

ROLLINS, INC. AND SUBSIDIARIES

Revenue from external customers, classified by significant product and service offerings, was as follows:

| Three Months Ended March 31, |

|||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Residential revenue | $ |

|

$ | ||||||||

| Commercial revenue |

|

||||||||||

| Termite completions, bait monitoring, & renewals |

|

||||||||||

| Franchise revenues |

|

||||||||||

| Other revenues |

|

||||||||||

| Total Revenues | $ |

|

$ | ||||||||

The Company records unearned revenue when we have either received payment or contractually have the right to bill for services in advance of the services or performance obligations being performed. Unearned revenue recognized in the three months ended March 31, 2025 and 2024 was $67.0 million and $61.9 million. Changes in unearned revenue were as follows:

| Three Months Ended March 31, |

|||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Beginning balance | $ |

|

$ | ||||||||

| Deferral of unearned revenue |

|

||||||||||

| Recognition of unearned revenue | ( |

( |

|||||||||

| Ending balance | $ |

|

$ | ||||||||

As of March 31, 2025 and December 31, 2024, the Company had long-term unearned revenue of $42.2 million and $43.0 million, respectively, recorded in other long-term accrued liabilities. Unearned short-term revenue is recognized over the next 12-month period. We recognized $45.2 million and $43.1 million of revenue in the quarters ended March 31, 2025 and 2024, respectively, that was included in the balance of unearned revenue at the beginning of each respective fiscal year. The majority of unearned long-term revenue is recognized over a period of five years or less with immaterial amounts recognized through 2035.

Incremental Costs of Obtaining a Contract with a Customer

NOTE 5. ALLOWANCE FOR CREDIT LOSSES

The Company is exposed to credit losses primarily related to accounts receivables and financed receivables derived from customer services revenue. To reduce credit risk for residential pest control accounts receivable, we promote enrollment in our auto-pay programs. In general, we may suspend future services for customers with past due balances. The Company’s credit risk is generally low with a large number of individuals and entities comprising Rollins’ customer base and dispersion across many different geographical regions.

The Company manages its financed receivables on an aggregate basis when assessing and monitoring credit risks. The Company’s established credit evaluation and monitoring procedures seek to minimize the amount of business we conduct

10

ROLLINS, INC. AND SUBSIDIARIES

with higher risk customers. The credit quality of a potential obligor is evaluated at the loan origination based on an assessment of the individual’s credit bureau score. Rollins requires a potential obligor to have good credit worthiness with low risk before entering into a contract. Depending upon the individual’s credit score, the Company may accept with 100 % financing, require a significant down payment or turn down the contract. Delinquencies of accounts are monitored each month. Financed receivables include installment receivable amounts, some of which are due subsequent to one year from the balance sheet dates.

The Company’s allowances for credit losses for trade accounts receivable and financed receivables are developed using historical collection experience, current economic and market conditions, reasonable and supportable forecasts, and a review of the current status of customers’ receivables. The Company’s receivable pools are classified between residential customers, commercial customers, large commercial customers, and financed receivables. Accounts are written off against the allowance for credit losses when the Company determines that amounts are uncollectible, and recoveries of amounts previously written off are recorded when collected. The Company stops accruing interest to these receivables when they are deemed uncollectible. Below is a roll forward of the Company’s allowance for credit losses for the three months ended March 31, 2025 and 2024.

| Allowance for Credit Losses | |||||||||||||||||

| (in thousands) | Trade Receivables |

Financed Receivables |

Total Receivables |

||||||||||||||

| Balance at December 31, 2024 | $ |

|

$ |

|

$ |

|

|||||||||||

| Provision for expected credit losses | |||||||||||||||||

| Write-offs charged against the allowance | ( |

( |

( |

||||||||||||||

| Recoveries collected | |||||||||||||||||

| Balance at March 31, 2025 | $ |

|

$ |

|

$ |

|

|||||||||||

| Allowance for Credit Losses | |||||||||||||||||

| (in thousands) | Trade Receivables |

Financed Receivables |

Total Receivables |

||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | ||||||||||||||

| Provision for expected credit losses | |||||||||||||||||

| Write-offs charged against the allowance | ( |

( |

( |

||||||||||||||

| Recoveries collected | |||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | ||||||||||||||

NOTE 6. GOODWILL AND INTANGIBLE ASSETS

The following table summarizes changes in goodwill during the three months ended March 31, 2025 (in thousands):

| Balance at December 31, 2024 | $ |

|

|||

| Additions | |||||

| Measurement adjustments | ( |

||||

| Adjustments due to currency translation and other | |||||

| Balance at March 31, 2025 | $ |

|

|||

11

ROLLINS, INC. AND SUBSIDIARIES

The following table sets forth the components of indefinite-lived and amortizable intangible assets as of March 31, 2025 and December 31, 2024 (in thousands):

| March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||

| Gross | Accumulated Amortization |

Carrying Value |

Gross | Accumulated Amortization |

Carrying Value |

Useful Life in Years |

|||||||||||||||||||||||||||||||||||

| Amortizable intangible assets: | |||||||||||||||||||||||||||||||||||||||||

| Customer contracts | $ | $ | ( |

$ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||

| Trademarks and tradenames | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Other intangible assets | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Total amortizable intangible assets | $ | $ | ( |

$ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||

| Indefinite-lived intangible assets | |||||||||||||||||||||||||||||||||||||||||

| Total customer contracts and other intangible assets | $ | $ | |||||||||||||||||||||||||||||||||||||||

Amortization expense related to intangible assets was $20.8 million and $18.7 million for the three months ended March 31, 2025 and 2024, respectively. Customer contracts and other amortizable intangible assets are amortized on a straight-line basis over their economic useful lives.

Estimated amortization expense for the existing carrying amount of amortizable intangible assets for each of the five succeeding fiscal years as of March 31, 2025 are as follows:

| (in thousands) | |||||

| 2025 (excluding the three months ended March 31, 2025) | $ | ||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| 2029 | |||||

NOTE 7. DEBT

Components of debt were as follows (in thousands):

| March 31, 2025 | December 31, 2024 | ||||||||||

| 2035 Senior Notes | $ |

|

$ | ||||||||

| Revolving Credit Facility |

|

||||||||||

| Total debt | $ |

|

$ | ||||||||

| Less: Unamortized debt discount | ( |

||||||||||

| Less: Unamortized debt issuance costs | ( |

( |

|||||||||

| Total Long-term debt | $ |

|

$ | ||||||||

Long-term Debt

2035 Senior Notes

In February 2025, we issued ten-year notes with an aggregate principal amount of $500 million due on February 24, 2035 (the “2035 Senior Notes”) in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act. We issued the 2035 Senior Notes at 98.443 % of par, representing a discount of $7.8 million, and paid approximately $5.4 million for debt issuance costs. The interest is payable semi-annually in arrears on February 24 and

12

ROLLINS, INC. AND SUBSIDIARIES

August 24 of each year at 5.25 % per annum, beginning on August 24, 2025, and the entire principal amount is due at the time of maturity. We used the net proceeds from this offering primarily to repay outstanding borrowings under the Revolving Credit Facility, as defined below, as well as for general corporate purposes.

The 2035 Senior Notes are senior unsecured obligations of the Company and, at the time of issuance, were guaranteed by the Company’s subsidiaries that were guarantors under its Revolving Credit Facility, provided for by the Credit Agreement defined below. Subsequent to the issuance of the 2035 Senior Notes, and described further below, we amended our Credit Agreement to release the Company's subsidiaries as guarantors.

The indenture governing the 2035 Senior Notes contains customary covenants that limit the Company and its subsidiaries’ ability to, among other things, incur liens and certain types of indebtedness. The indenture also provides for customary events of default, which, if any of them occurs, would permit or require the principal, premium, if any, interest and any other monetary obligations on all the then outstanding 2035 Senior Notes to be due and payable immediately. We were in compliance with all covenants as of March 31, 2025.

The effective interest rate of our 2035 Senior Notes was 5.6 % as of March 31, 2025.

Revolving Credit Facility

In February 2023, the Company entered into a credit agreement (the "Credit Agreement") with, among others, JPMorgan Chase Bank, N.A. (“JPMorgan Chase”), as administrative agent (in such capacity, the “Administrative Agent”).

In March 2025, the Company entered into Amendment No. 1 to the Credit Agreement (the “Amendment No 1”), among the Company, JPMorgan Chase, and the lenders party thereto, which amended the Credit Agreement with, among others, the Company and the Administrative Agent. The Amendment No. 1, among other things, released each of Orkin, LLC, Northwest Exterminating Co., LLC, Clark Pest Control of Stockton, Inc. and Hometeam Pest Defense, Inc. (collectively, the “Existing Guarantors”) as guarantors under the Credit Agreement. Following the release of the Existing Guarantors from their guarantees of the obligations under the Credit Agreement, no subsidiary of the Company guarantees the obligations under the Credit Agreement.

The Credit Agreement provides for a $1.0 billion revolving credit facility ("Revolving Credit Facility"), which may be denominated in U.S. Dollars and other currencies, subject to a $400 million foreign currency sublimit. Rollins has the ability to expand its borrowing availability under the Credit Agreement in the form of increased revolving commitments or one or more tranches of term loans by up to an additional $750 million, subject to the agreement of the participating lenders and certain other customary conditions. The maturity date of the loans under the Credit Agreement is February 24, 2028.

Loans under the Credit Agreement bear interest, at Rollins’ election, at (i) for loans denominated in U.S. Dollars, (A) an alternate base rate (subject to a floor of 0.00 %), which is the greatest of (x) the prime rate publicly announced from time to time by JPMorgan Chase, (y) the greater of the federal funds effective rate and the Federal Reserve Bank of New York overnight bank funding rate, plus 50 basis points, and (z) Adjusted Term SOFR for a one month interest period, plus a margin ranging from 0.00 % to 0.50 % per annum based on Rollins’ consolidated total net leverage ratio; or (B) the greater of term SOFR for the applicable interest period plus 10 basis points (“Adjusted Term SOFR”) and zero , plus a margin ranging from 1.00 % to 1.50 % per annum based on Rollins’ consolidated total net leverage ratio; and (ii) for loans denominated in other currencies, such interest rates as set forth in the Credit Agreement.

The Credit Agreement contains customary terms and conditions, including, without limitation, certain financial covenants including covenants restricting Rollins’ ability to incur certain indebtedness or liens, or to merge or consolidate with or sell substantially all of its assets to another entity. Further, the Credit Agreement contains a financial covenant restricting Rollins’ ability to permit the ratio of Rollins’ consolidated total net debt to EBITDA to exceed 3.50 to 1.00. Following certain acquisitions, Rollins may elect to increase the financial covenant level to 4.00 to 1.00 temporarily. The Company is in compliance with applicable debt covenants as of March 31, 2025.

As of March 31, 2025, the Company had no outstanding borrowings under the Revolving Credit Facility. As of December 31, 2024, the Company had outstanding borrowings of $397.0 million under the Revolving Credit Facility.

13

ROLLINS, INC. AND SUBSIDIARIES

Short-term Debt

Commercial Paper Program

In March 2025, we established a commercial paper program under which we may issue unsecured commercial paper up to a total of $1 billion outstanding at any time, with maturities of up to 397 days from the date of issue. The net proceeds from the issuance of commercial paper are expected to be used for general corporate purposes. As of March 31, 2025, there were no outstanding borrowings under the commercial paper program.

Letters of Credit

The Company maintained $82.4 million in letters of credit as of March 31, 2025 and $72.0 million as of December 31, 2024. These letters of credit are required by the Company’s insurance companies, due to the Company’s high deductible insurance program, to secure various workers’ compensation and casualty insurance contracts coverage. The Company believes that it has adequate liquid assets, funding sources and insurance accruals to accommodate potential future insurance claims.

NOTE 8. FAIR VALUE MEASUREMENT

Assets and liabilities recorded at fair value are measured using a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The levels of the fair value hierarchy are:

•Level 1: observable inputs such as quoted prices in active markets for identical assets or liabilities;

•Level 2: inputs other than quoted prices in active markets in Level 1 that are either directly or indirectly observable; and

•Level 3: unobservable inputs for which little or no market data exists.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Debt Securities

As of March 31, 2025 and December 31, 2024, we had investments in international bonds of $8.1 million and $8.2 million, respectively. These bonds are accounted for as available for sale securities and are Level 2 assets under the fair value hierarchy. The bonds are recorded at their fair market values and reported within other current assets and other assets in our condensed consolidated statement of financial position. The unrealized gain or loss activity during the three months ended March 31, 2025 and 2024 was not significant.

Contingent Consideration

As of March 31, 2025 and December 31, 2024, the Company had $25.0 million and $21.0 million of acquisition holdback and earnout liabilities payable to former owners of acquired companies, respectively. The earnout liabilities were adjusted to reflect the expected probability of payout, and both earnout and holdback liabilities were discounted to their net present value on the Company’s books and are considered Level 3 liabilities. The table below presents a summary of the changes in fair value for these liabilities.

| Three Months Ended March 31, |

|||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Beginning balance | $ |

|

$ | ||||||||

| New acquisitions and measurement adjustments |

|

||||||||||

| Payouts | ( |

( |

|||||||||

| Interest and fair value adjustments |

|

||||||||||

| Charge offset, forfeit and other |

|

||||||||||

| Ending balance | $ |

|

$ | ||||||||

14

ROLLINS, INC. AND SUBSIDIARIES

Other Fair Value Disclosures

The carrying amount of cash and cash equivalents, trade and financed receivables, accounts payable, and short-term liabilities approximate fair value due to their short-term nature. The carrying amounts of borrowings outstanding under our Revolving Credit Facility approximate fair value, as interest rates are variable and reflective of market rates.

The following table presents the aggregate fair value and carrying value of our 2035 Senior Notes, which are classified as Level 2 within the fair value hierarchy:

| March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||

| (in thousands) | Fair Value | Carrying Value | Fair Value | Carrying Value | |||||||||||||||||||

| 2035 Senior Notes | $ |

|

$ |

|

$ | $ | |||||||||||||||||

NOTE 9. CONTINGENCIES

In the normal course of business, the Company and its subsidiaries are involved in, and will continue to be involved in, various claims, arbitrations, contractual disputes, investigations, and regulatory and litigation matters relating to, and arising out of, our businesses and our operations. These matters may involve, but are not limited to, allegations that our services or vehicles caused damage or injury, claims that our services did not achieve the desired results, claims related to acquisitions and allegations by federal, state or local authorities, including taxing authorities, of violations of regulations or statutes. In addition, we are parties to employment-related investigations, cases, and claims from time to time, which may include claims on a representative or class action basis alleging wage and hour law violations, claims filed under California's Private Attorneys General Act, and claims related to our enforcement of post-employment restrictive covenants. We are also involved from time to time in certain environmental matters primarily arising in the normal course of business. We evaluate pending and threatened claims and establish loss contingency reserves based upon outcomes we currently believe to be probable and reasonably estimable in accordance with ASC 450.

The Company retains, up to specified limits, certain risks related to general liability, workers’ compensation and auto liability. The estimated costs of existing and future claims under the retained loss program are accrued based upon historical trends as incidents occur, whether reported or unreported (although actual settlement of the claims may not be made until future periods) and may be subsequently revised based on developments relating to such claims. The Company contracts with an independent third-party actuary to provide the Company an estimated liability based upon historical claims information. The actuarial study is a major consideration in establishing the reserve, along with management’s knowledge of changes in business practice and existing claims compared to current balances. Management’s judgment is inherently subjective as a number of factors are outside management’s knowledge and control. Additionally, historical information is not always an accurate indication of future events. The accruals and reserves we hold are based on estimates that involve a degree of judgment and are inherently variable and could be overestimated or insufficient. If actual claims exceed our estimates, our operating results could be materially affected, and our ability to take timely corrective actions to limit future costs may be limited.

Item 103 of SEC Regulation S-K requires disclosure of certain environmental legal proceedings if the proceeding reasonably involves potential monetary sanctions of $300,000 or more. The Company has received a notice of alleged violations and information requests from local governmental authorities in California for our Orkin and Clark Pest Control operations and is currently working with several local governments regarding compliance with environmental regulations governing the management of hazardous waste and pesticide disposal. The investigation appears to be part of a broader effort to investigate waste handling and disposal processes of a number of industries. While we are unable to predict the outcome of this investigation, we do not believe the outcome will have a material effect on our results of operations, financial condition, or cash flows.

Management does not believe that any pending claim, proceeding or litigation, regulatory action or investigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial position, results of operations or liquidity; however, it is possible that an unfavorable outcome of some or all of the matters could result in a charge that might be material to the results of an individual quarter or year.

15

ROLLINS, INC. AND SUBSIDIARIES

NOTE 10. STOCKHOLDERS' EQUITY

During the three months ended March 31, 2025, the Company paid $79.9 million, or $0.165 per share, in cash dividends compared to $72.6 million, or $0.150 per share, during the same period in 2024.

The Company withholds shares from employees for the payment of their taxes on equity awards that have vested. The Company withheld $14.7 million and $11.3 million in connection with employee tax obligations during the three month periods ended March 31, 2025 and 2024, respectively.

The Company did not repurchase shares on the open market during the three months ended March 31, 2025 and March 31, 2024.

The following table summarizes the components of the Company’s stock-based compensation programs, including time-lapsed restricted share awards, performance share unit awards, and employee stock purchase plan, recorded as expense:

| Three Months Ended March 31, |

|||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Stock-based compensation expense | $ |

|

$ | ||||||||

NOTE 11. EARNINGS PER SHARE

The Company reports both basic and diluted earnings per share. Basic earnings per share is computed by dividing net income available to participating common stockholders by the weighted average number of participating common shares outstanding for the period. Diluted earnings per share is calculated by dividing the net income available to participating common shareholders by the diluted weighted average number of shares outstanding for the period. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive equity.

A reconciliation of weighted average shares outstanding is as follows (in thousands):

| Three Months Ended March 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| Weighted-average outstanding common shares | |||||||||||

| Add participating securities: | |||||||||||

| Weighted-average time-lapse restricted awards | |||||||||||

| Total weighted-average shares outstanding – basic | |||||||||||

| Dilutive effect of restricted stock units and PSUs | |||||||||||

| Weighted-average shares outstanding – diluted | |||||||||||

NOTE 12. INCOME TAXES

The Company’s provision for income taxes is recorded on an interim basis based upon the Company’s estimate of the annual effective income tax rate for the full year applied to “ordinary” income or loss, adjusted each quarter for discrete items. The Company recorded a provision for income taxes of $32.3 million and $30.2 million for the three months ended March 31, 2025 and 2024, respectively.

The Company’s effective tax rate decreased to 23.5 % in the first quarter of 2025 compared with 24.3 % in the first quarter of 2024. The lower rate for the quarter was primarily due to increased benefits from stock-based compensation.

NOTE 13. SEGMENT AND GEOGRAPHIC INFORMATION

The Company operates under one reportable segment which contains our residential, commercial, and termite service offerings. The Company's chief operating decision maker ("CODM") is the chief executive officer. The CODM uses net income to assess financial performance and allocate resources. This financial metric is used by the CODM to make key

16

ROLLINS, INC. AND SUBSIDIARIES

operating decisions, such as the determination of the rate of growth investments and the allocation of budget between cost categories. The measure of segment assets is reported on the balance sheet as total consolidated assets.

The following table presents selected financial information with respect to the Company’s single reportable segment:

| Three Months Ended March 31, | |||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Revenue | $ |

|

$ | ||||||||

| Less: | |||||||||||

| Cost of services provided (exclusive of depreciation and amortization below): | |||||||||||

| Employee expenses |

|

||||||||||

| Materials and supplies |

|

||||||||||

| Insurance and claims |

|

||||||||||

| Fleet expenses |

|

||||||||||

Other cost of services provided (1)

|

|

||||||||||

| Total cost of services provided (exclusive of depreciation and amortization below) | $ |

|

$ | ||||||||

| Sales, general and administrative: | |||||||||||

| Selling and marketing expenses |

|

||||||||||

| Administrative employee expenses |

|

||||||||||

| Insurance and claims |

|

||||||||||

| Fleet expenses |

|

||||||||||

Other sales, general and administrative (2)

|

|

||||||||||

| Total sales, general and administrative | $ |

|

$ | ||||||||

| Depreciation and amortization |

|

||||||||||

| Interest expense, net |

|

||||||||||

| Other income, net | ( |

||||||||||

| Income tax expense |

|

||||||||||

| Net income | $ |

|

$ | ||||||||

1) Other cost of services provided includes facilities costs, professional services, maintenance and repairs, software license costs, and other expenses directly related to providing services.

2) Other sales, general and administrative includes facilities costs, professional services, maintenance and repairs, software license costs, bad debt expense, and other administrative expenses.

See the consolidated financial statements for other financial information regarding the Company’s reportable segment. See Note 4, Revenue for further information on revenue.

The Company's long-lived tangible assets, as well as the Company's operating lease right-of-use assets recognized in the condensed consolidated statements of financial position were located as follows:

| March 31, 2025 |

December 31, 2024 |

||||||||||

| (in thousands) | |||||||||||

| United States | $ |

|

$ | ||||||||

| International |

|

||||||||||

17

ROLLINS, INC. AND SUBSIDIARIES

NOTE 14. SUBSEQUENT EVENTS

Saela Acquisition

On April 2, 2025, the Company acquired 100 % of Saela Holdings, LLC (“Saela”) for $200 million, subject to post-closing adjustments related to the assets and liabilities of Saela at closing, plus $15 million of contingent consideration that will be paid upon the attainment of future growth and profitability levels. The acquisition is expected to be accounted for as a business combination and the assets acquired and liabilities assumed will be measured at fair value as of the acquisition date. The initial purchase price allocation is not complete as of the date of this filing. We funded this acquisition using cash on hand and borrowings under the commercial paper program.

Quarterly Dividend

On April 22, 2025, the Company’s Board of Directors declared a regular quarterly cash dividend on its common stock of $0.165 per share payable on June 10, 2025 to shareholders of record at the close of business on May 12, 2025.

18

ROLLINS, INC. AND SUBSIDIARIES

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report on Form 10-Q.

GENERAL OPERATING COMMENTS

Below is a summary of the key operating results for the three months ended March 31, 2025:

•First quarter revenues were $822.5 million, an increase of 9.9% over the first quarter of 2024 with organic revenues* increasing 7.4%. The stronger dollar versus foreign currencies in countries where we operate reduced revenues by 40 basis points during the quarter.

•Quarterly operating income was $142.6 million, an increase of 7.7% over the first quarter of 2024. Quarterly operating margin was 17.3%, a decrease of 40 basis points versus the first quarter of 2024. Adjusted operating income* was $146.9 million, an increase of 6.7% over the prior year. Adjusted operating income margin* was 17.9%, a decrease of 50 basis points compared to the prior year.

•Adjusted EBITDA* was $171.9 million, an increase of 6.9% over the prior year. Adjusted EBITDA margin* was 20.9%, a decrease of 60 basis points versus the first quarter of 2024.

•Quarterly net income was $105.2 million, an increase of 11.5% over the prior year. Adjusted net income* was $107.9 million, an increase of 9.7% over the prior year.

•Quarterly EPS was $0.22 per diluted share, a 15.8% increase over the prior year EPS of $0.19. Adjusted EPS* was $0.22 per diluted share, an increase of 10.0% over the prior year.

•Operating cash flow was $146.9 million for the quarter, an increase of 15.3% compared to the prior year. The Company invested $27.2 million in acquisitions, $6.8 million in capital expenditures, and paid dividends totaling $79.9 million.

Demand remains favorable to start the second quarter and the pipeline of acquisition activity remains healthy. Although we continue to navigate a highly uncertain macroeconomic environment, we believe we are well positioned to continue to deliver strong results in 2025.

We remain focused on driving 7% to 8% organic revenue growth while adding 3% to 4% of inorganic revenue growth for 2025. We continue to focus on improving the efficiency of our business model while investing in programs aimed at growing our business across our service offerings.

*Amounts are non-GAAP financial measures. See the schedules below for a discussion of non-GAAP financial metrics including a reconciliation of the most directly comparable GAAP measure.

IMPACT OF ECONOMIC TRENDS

The continued disruption in economic markets due to inflation, changing interest rates, business interruptions due to natural disasters and changes in weather patterns, employee shortages, and supply chain issues, all pose challenges which may adversely affect our future performance. The Company continues to execute various strategies previously implemented to help mitigate the impact of these economic disruptors. However, the Company cannot reasonably estimate whether these strategies will help mitigate the impact of these economic disruptors in the future.

Additionally, the Company continues to monitor ongoing changes to global trade policies, including the imposition of tariffs. The broader economic impact of these policies is uncertain, and while we may experience changes in fleet-related expenses and materials and supplies, we do not expect to be materially affected.

The Company’s condensed consolidated financial statements reflect estimates and assumptions made by management that affect the reported amounts of assets and liabilities and related disclosures as of the date of the condensed consolidated financial statements. The Company considered the impact of economic trends on the assumptions and estimates used in preparing the condensed consolidated financial statements. In the opinion of management, all material adjustments necessary for a fair presentation of the Company’s financial results for the quarter have been made. These adjustments are

19

ROLLINS, INC. AND SUBSIDIARIES

of a normal recurring nature but are complicated by the continued uncertainty surrounding these economic trends. The severity, magnitude and duration of certain economic trends continue to be uncertain and are difficult to predict. Therefore, our accounting estimates and assumptions may change over time in response to economic trends and may change materially in future periods.

The extent to which these economic trends will continue to impact the Company’s business, financial condition and results of operations is uncertain. Therefore, we cannot reasonably estimate the full future impacts of these matters at this time.

RESULTS OF OPERATIONS

Quarter ended March 31, 2025 compared to quarter ended March 31, 2024

| Three Months Ended March 31, | ||||||||||||||||||||

| Variance | ||||||||||||||||||||

| (in thousands, except per share data) | 2025 | 2024 | $ | % | ||||||||||||||||

| GAAP Metrics | ||||||||||||||||||||

| Revenues | $ | 822,504 | $ | 748,349 | $ | 74,155 | 9.9 | % | ||||||||||||

Gross profit (1)

|

$ | 422,370 | $ | 382,791 | $ | 39,579 | 10.3 | % | ||||||||||||

Gross profit margin (1)

|

51.4 | % | 51.2 | % | 20 | bps | ||||||||||||||

| Operating income | $ | 142,648 | $ | 132,424 | $ | 10,224 | 7.7 | % | ||||||||||||

| Operating income margin | 17.3 | % | 17.7 | % | (40) | bps | ||||||||||||||

| Net income | $ | 105,248 | $ | 94,394 | $ | 10,854 | 11.5 | % | ||||||||||||

| EPS | $ | 0.22 | $ | 0.19 | $ | 0.03 | 15.8 | % | ||||||||||||

| Operating cash flow | $ | 146,892 | $ | 127,433 | $ | 19,459 | 15.3 | % | ||||||||||||

| Non-GAAP Metrics | ||||||||||||||||||||

Adjusted operating income (2)

|

$ | 146,861 | $ | 137,689 | $ | 9,172 | 6.7 | % | ||||||||||||

Adjusted operating margin (2)

|

17.9 | % | 18.4 | % | (50) | bps | ||||||||||||||

Adjusted net income (2)

|

$ | 107,868 | $ | 98,357 | $ | 9,511 | 9.7 | % | ||||||||||||

Adjusted EPS (2)

|

$ | 0.22 | $ | 0.20 | $ | 0.02 | 10.0 | % | ||||||||||||

Adjusted EBITDA (2)

|

$ | 171,857 | $ | 160,783 | $ | 11,074 | 6.9 | % | ||||||||||||

Adjusted EBITDA margin (2)

|

20.9 | % | 21.5 | % | (60) | bps | ||||||||||||||

Free cash flow (2)

|

$ | 140,111 | $ | 120,262 | $ | 19,849 | 16.5 | % | ||||||||||||

(1) Exclusive of depreciation and amortization

(2) Amounts are non-GAAP financial measures. See "Non-GAAP Financial Measures" of this Form 10-Q for a discussion of non-GAAP financial metrics including a reconciliation of the most directly comparable GAAP measure.

20

ROLLINS, INC. AND SUBSIDIARIES

The following table presents financial information, including our significant expense categories, for the three months ended March 31, 2025 and 2024:

| Three Months Ended March 31, | ||||||||||||||

| (unaudited, in thousands) | 2025 | 2024 | ||||||||||||

| $ | % of Revenue | $ | % of Revenue | |||||||||||

| Revenue | $ | 822,504 | 100.0 | % | $ | 748,349 | 100.0 | % | ||||||

| Less: | ||||||||||||||

| Cost of services provided (exclusive of depreciation and amortization below): | ||||||||||||||

| Employee expenses | 261,724 | 31.8 | % | 238,529 | 31.9 | % | ||||||||

| Materials and supplies | 48,491 | 5.9 | % | 44,786 | 6.0 | % | ||||||||

| Insurance and claims | 16,524 | 2.0 | % | 17,644 | 2.4 | % | ||||||||

| Fleet expenses | 36,857 | 4.5 | % | 30,697 | 4.1 | % | ||||||||

Other cost of services provided (1)

|

36,538 | 4.4 | % | 33,902 | 4.5 | % | ||||||||

| Total cost of services provided (exclusive of depreciation and amortization below) | $ | 400,134 | 48.6 | % | $ | 365,558 | 48.8 | % | ||||||

| Sales, general and administrative: | ||||||||||||||

| Selling and marketing expenses | 98,250 | 11.9 | % | 82,911 | 11.1 | % | ||||||||

| Administrative employee expenses | 81,481 | 9.9 | % | 75,778 | 10.1 | % | ||||||||

| Insurance and claims | 10,004 | 1.2 | % | 10,526 | 1.4 | % | ||||||||

| Fleet expenses | 9,403 | 1.1 | % | 7,765 | 1.0 | % | ||||||||

Other sales, general and administrative (2)

|

51,375 | 6.2 | % | 46,077 | 6.2 | % | ||||||||

| Total sales, general and administrative | $ | 250,513 | 30.5 | % | $ | 223,057 | 29.8 | % | ||||||

| Depreciation and amortization | 29,209 | 3.6 | % | 27,310 | 3.6 | % | ||||||||

| Interest expense, net | 5,796 | 0.7 | % | 7,725 | 1.0 | % | ||||||||

| Other expense (income), net | (692) | (0.1) | % | 61 | — | % | ||||||||

| Income tax expense | 32,296 | 3.9 | % | 30,244 | 4.0 | % | ||||||||

| Net income | $ | 105,248 | 12.8 | % | $ | 94,394 | 12.6 | % | ||||||

1) Other cost of services provided includes facilities costs, professional services, maintenance & repairs, software license costs, and other expenses directly related to providing services.

2) Other sales, general and administrative includes facilities costs, professional services, maintenance & repairs, software license costs, bad debt expense, and other administrative expenses.

21

ROLLINS, INC. AND SUBSIDIARIES

Revenues

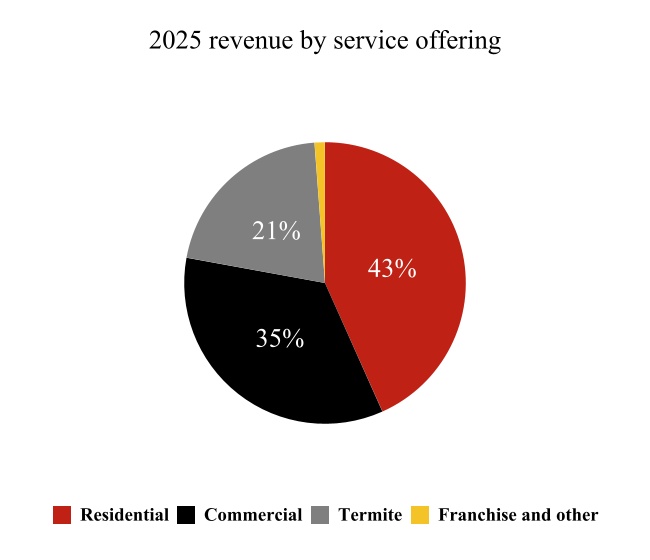

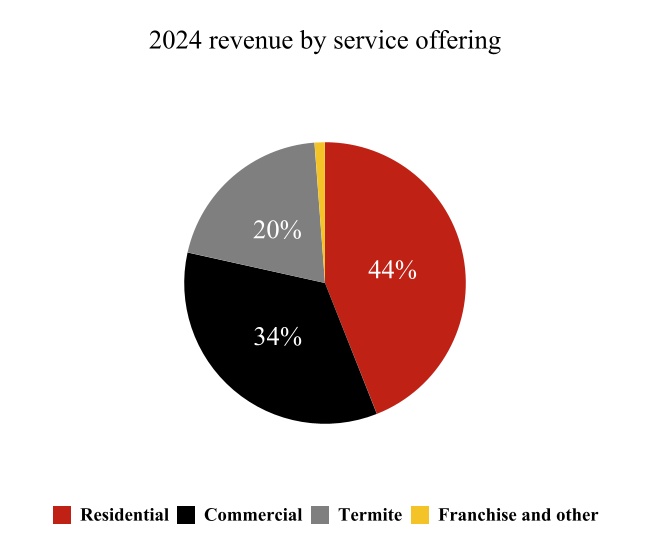

The following presents a summary of revenues by service offering for the first quarter ended March 31, 2025 and March 31, 2024, respectively:

Revenues for the quarter ended March 31, 2025 were $822.5 million, an increase of $74.2 million, or 9.9%, from 2024 revenues of $748.3 million. The increase in revenues was driven by demand from our customers across all major service offerings, partially offset by foreign currency headwind of 40 basis points, primarily related to the Canadian Dollar. Organic revenue* growth was 7.4% with acquisitions adding 2.5% in the quarter. Residential pest control revenue increased 8.2%, commercial pest control revenue increased 10.2% and termite and ancillary services grew 13.2% including both organic and acquisition-related growth in each area. Organic revenue* growth was strong across our service offerings, growing 5.7% in residential, 7.4% in commercial, and 11.1% in termite and ancillary activity, despite having one less business day in the quarter ended March 31, 2025 compared to the same quarter in 2024.

*Amounts are non-GAAP financial measures. See the schedules below for a discussion of non-GAAP financial metrics including a reconciliation of the most directly comparable GAAP measure.

Revenues are impacted by the seasonal nature of the Company’s pest and termite control services. The increase in pest activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the change in seasons), has historically resulted in an increase in the Company’s revenues as evidenced by the following table:

| Consolidated Net Revenues | |||||||||||||||||

| (in thousands) | 2025 | 2024 | 2023 | ||||||||||||||

| First Quarter | $ | 822,504 | $ | 748,349 | $ | 658,015 | |||||||||||

| Second Quarter | — | 891,920 | 820,750 | ||||||||||||||

| Third Quarter | — | 916,270 | 840,427 | ||||||||||||||

| Fourth Quarter | — | 832,169 | 754,086 | ||||||||||||||

| Year to date | $ | 822,504 | $ | 3,388,708 | $ | 3,073,278 | |||||||||||

Gross Profit (exclusive of Depreciation and Amortization)

Gross profit for the quarter ended March 31, 2025 was $422.4 million, an increase of $39.6 million, or 10.3%, compared to $382.8 million for the quarter ended March 31, 2024. Gross margin improved 20 basis points to 51.4% in 2025 compared to 51.2% in 2024, as pricing more than offset inflationary pressures. We saw leverage across a number of cost categories, including 10 basis points in each of employee expenses and materials and supplies, with the most significant leverage in insurance and claims of 40 basis points. This was partially offset by 40 basis points of higher fleet expenses associated with our leased vehicles due to higher lease costs.

22

ROLLINS, INC. AND SUBSIDIARIES

Sales, General and Administrative

For the quarter ended March 31, 2025, sales, general and administrative ("SG&A") expenses were $250.5 million, an increase of $27.5 million, or 12.3%, compared to the quarter ended March 31, 2024.

As a percentage of revenue, SG&A increased 70 basis points to 30.5% from 29.8% in the prior year. Selling and marketing costs have increased by 80 basis points as we continue to invest in growth initiatives, including advertising. This was partially offset by leverage associated with lower administrative costs and insurance and claims costs.

Depreciation and Amortization

For the quarter ended March 31, 2025, depreciation and amortization increased $1.9 million, or 7.0%, compared to the quarter ended March 31, 2024. The increase was due to higher amortization of intangible assets from acquisitions.

Operating Income

For the quarter ended March 31, 2025, operating income increased $10.2 million, or 7.7%, compared to the prior year.

As a percentage of revenue, operating income was 17.3%, a decrease of 40 basis points compared to the first quarter of 2024. Operating margin declined mostly due to investments in growth initiatives and higher fleet costs, partially offset by leverage in insurance and claims, administrative costs, employee expenses, and materials and supplies.

Interest Expense, Net

During the quarter ended March 31, 2025, interest expense, net decreased $1.9 million compared to the prior year due to both a lower average outstanding debt balance compared to the same quarter in the prior year and a lower average interest rate on our borrowings. For full year 2025, we expect to incur a higher level of interest expense compared to 2024 due to a higher level of acquisition activity. We expect to incur between $8.0 million to $10.0 million of interest expense in the second quarter of 2025.

Other Income, Net

During the quarter ended March 31, 2025, other income increased $0.8 million primarily due to higher gains on non-operational asset sales.

Income Taxes

The Company’s effective tax rate was 23.5% in the first quarter of 2025 and 24.3% in the first quarter of 2024. The lower rate for the quarter was primarily due to increased benefits from stock-based compensation. We expect the effective tax rate to approximate 26% for 2025.

23

ROLLINS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures

Reconciliation of GAAP and non-GAAP Financial Measures

A non-GAAP financial measure is a numerical measure of financial performance, financial position, or cash flows that either 1) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of operations, balance sheet or statement of cash flows, or 2) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

These measures should not be considered in isolation or as a substitute for revenues, net income, earnings per share or other performance measures prepared in accordance with GAAP. Management believes all of these non-GAAP financial measures are useful to provide investors with information about current trends in, and period-over-period comparisons of, the Company's results of operations. An analysis of any non-GAAP financial measure should be used in conjunction with results presented in accordance with GAAP.

The Company has used the following non-GAAP financial measures in this Form 10-Q:

Organic revenues

Organic revenues are calculated as revenues less the revenues from acquisitions completed within the prior 12 months and excluding the revenues from divested businesses. Acquisition revenues are based on the trailing 12-month revenue of our acquired entities. Management uses organic revenues, and organic revenues by type to compare revenues over various periods excluding the impact of acquisitions and divestitures.

Adjusted operating income and adjusted operating margin

Adjusted operating income and adjusted operating margin are calculated by adding back to net income those expenses resulting from the amortization of certain intangible assets, adjustments to the fair value of contingent consideration resulting from the acquisition of Fox Pest Control, and restructuring costs related to restructuring and workforce reduction plans. Adjusted operating margin is calculated as adjusted operating income divided by revenues. Management uses adjusted operating income and adjusted operating margin as measures of operating performance because these measures allow the Company to compare performance consistently over various periods.

Adjusted net income and adjusted EPS

Adjusted net income and adjusted EPS are calculated by adding back to the GAAP measures amortization of certain intangible assets, adjustments to the fair value of contingent consideration resulting from the acquisition of Fox Pest Control, and restructuring costs related to restructuring and workforce reduction plans, and excluding gains and losses on the sale of non-operational assets and gains on the sale of businesses, and by further subtracting the tax impact of those expenses, gains, or losses. Management uses adjusted net income and adjusted EPS as measures of operating performance because these measures allow the Company to compare performance consistently over various periods.

EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, incremental EBITDA margin and adjusted incremental EBITDA margin

EBITDA is calculated by adding back to net income depreciation and amortization, interest expense, net, and provision for income taxes. EBITDA margin is calculated as EBITDA divided by revenues. Adjusted EBITDA and adjusted EBITDA margin are calculated by further adding back those expenses resulting from the adjustments to the fair value of contingent consideration resulting from the acquisition of Fox Pest Control, restructuring costs related to restructuring and workforce reduction plans, and excluding gains and losses on the sale of non-operational assets and gains on the sale of businesses. Management uses EBITDA, EBITDA margin, adjusted EBITDA and adjusted EBITDA margin as measures of operating performance because these measures allow the Company to compare performance consistently over various periods. Incremental EBITDA margin is calculated as the change in EBITDA divided by the change in revenue. Management uses incremental EBITDA margin as a measure of operating performance because this measure allows the Company to compare performance consistently over various periods. Adjusted incremental EBITDA margin is calculated as the change in adjusted EBITDA divided by the change in revenue. Management uses adjusted incremental EBITDA margin as a measure

24

ROLLINS, INC. AND SUBSIDIARIES

of operating performance because this measure allows the Company to compare performance consistently over various periods.

Free cash flow and free cash flow conversion

Free cash flow is calculated by subtracting capital expenditures from cash provided by operating activities. Management uses free cash flow to demonstrate the Company’s ability to maintain its asset base and generate future cash flows from operations. Free cash flow conversion is calculated as free cash flow divided by net income. Management uses free cash flow conversion to demonstrate how much net income is converted into cash. Management believes that free cash flow is an important financial measure for use in evaluating the Company’s liquidity. Free cash flow should be considered in addition to, rather than as a substitute for, net cash provided by operating activities as a measure of our liquidity. Additionally, the Company’s definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, management believes it is important to view free cash flow as a measure that provides supplemental information to our consolidated statements of cash flows.

Adjusted sales, general, and administrative ("SG&A")

Adjusted SG&A is calculated by removing the adjustments to the fair value of contingent consideration resulting from the acquisition of Fox Pest Control. Management uses adjusted SG&A to compare SG&A expenses consistently over various periods.

Leverage ratio

Leverage ratio, a financial valuation measure, is calculated by dividing adjusted net debt by adjusted EBITDAR. Adjusted net debt is calculated by adding operating lease liabilities to total long-term debt less a cash adjustment of 90% of total consolidated cash. Adjusted EBITDAR is calculated by adding back to net income depreciation and amortization, interest expense, net, provision for income taxes, operating lease cost, and stock-based compensation expense. Management uses leverage ratio as an assessment of overall liquidity, financial flexibility, and leverage.

25

ROLLINS, INC. AND SUBSIDIARIES

Set forth below is a reconciliation of the non-GAAP financial measures contained in this report with their most directly comparable GAAP measures (unaudited, in thousands, except per share data and margins).

| Three Months Ended March 31, | |||||||||||||||||||||||

| Variance | |||||||||||||||||||||||

| 2025 | 2024 | $ | % | ||||||||||||||||||||

| Reconciliation of Revenues to Organic Revenues | |||||||||||||||||||||||

| Revenues | $ | 822,504 | $ | 748,349 | 74,155 | 9.9 | |||||||||||||||||

| Revenues from acquisitions | (18,550) | — | (18,550) | 2.5 | |||||||||||||||||||

| Organic revenues | $ | 803,954 | $ | 748,349 | 55,605 | 7.4 | |||||||||||||||||

| Reconciliation of Residential Revenues to Organic Residential Revenues | |||||||||||||||||||||||

| Residential revenues | $ | 356,313 | $ | 329,338 | 26,975 | 8.2 | |||||||||||||||||

| Residential revenues from acquisitions | (8,366) | — | (8,366) | 2.5 | |||||||||||||||||||

| Residential organic revenues | $ | 347,947 | $ | 329,338 | 18,609 | 5.7 | |||||||||||||||||

| Reconciliation of Commercial Revenues to Organic Commercial Revenues | |||||||||||||||||||||||

| Commercial revenues | $ | 284,357 | $ | 258,114 | 26,243 | 10.2 | |||||||||||||||||

| Commercial revenues from acquisitions | (7,032) | — | (7,032) | 2.8 | |||||||||||||||||||

| Commercial organic revenues | $ | 277,325 | $ | 258,114 | 19,211 | 7.4 | |||||||||||||||||

| Reconciliation of Termite and Ancillary Revenues to Organic Termite and Ancillary Revenues | |||||||||||||||||||||||

| Termite and ancillary revenues | $ | 172,130 | $ | 152,060 | 20,070 | 13.2 | |||||||||||||||||

| Termite and ancillary revenues from acquisitions | (3,152) | — | (3,152) | 2.1 | |||||||||||||||||||

| Termite and ancillary organic revenues | $ | 168,978 | $ | 152,060 | 16,918 | 11.1 | |||||||||||||||||

26

ROLLINS, INC. AND SUBSIDIARIES

| Three Months Ended March 31, | Variance | ||||||||||||||||||||||

| 2025 | 2024 | $ | % | ||||||||||||||||||||

| Reconciliation of Operating Income to Adjusted Operating Income and Adjusted Operating Income Margin | |||||||||||||||||||||||

| Operating income | $ | 142,648 | $ | 132,424 | |||||||||||||||||||

Fox acquisition-related expenses (1)

|

4,213 | 5,265 | |||||||||||||||||||||

| Adjusted operating income | $ | 146,861 | $ | 137,689 | 9,172 | 6.7 | |||||||||||||||||

| Revenues | $ | 822,504 | $ | 748,349 | |||||||||||||||||||

| Operating income margin | 17.3 | % | 17.7 | % | |||||||||||||||||||

| Adjusted operating margin | 17.9 | % | 18.4 | % | |||||||||||||||||||

| Reconciliation of Net Income to Adjusted Net Income and Adjusted EPS | |||||||||||||||||||||||

| Net income | $ | 105,248 | $ | 94,394 | |||||||||||||||||||

Fox acquisition-related expenses (1)

|

4,213 | 5,265 | |||||||||||||||||||||

Gain on sale of assets, net (2)

|

(692) | 61 | |||||||||||||||||||||

Tax impact of adjustments (3)

|

(901) | (1,363) | |||||||||||||||||||||

| Adjusted net income | $ | 107,868 | $ | 98,357 | 9,511 | 9.7 | |||||||||||||||||

| EPS - basic and diluted | $ | 0.22 | $ | 0.19 | |||||||||||||||||||

Fox acquisition-related expenses (1)

|

0.01 | 0.01 | |||||||||||||||||||||

Gain on sale of assets, net (2)

|

— | — | |||||||||||||||||||||

Tax impact of adjustments (3)

|

— | — | |||||||||||||||||||||

Adjusted EPS - basic and diluted (4)

|

$ | 0.22 | $ | 0.20 | 0.02 | 10.0 | |||||||||||||||||

| Weighted average shares outstanding – basic | 484,414 | 484,131 | |||||||||||||||||||||

| Weighted average shares outstanding – diluted | 484,434 | 484,318 | |||||||||||||||||||||

| Reconciliation of Net Income to EBITDA, Adjusted EBITDA, EBITDA Margin, Incremental EBITDA Margin, Adjusted EBITDA Margin, and Adjusted Incremental EBITDA Margin | |||||||||||||||||||||||

| Net income | $ | 105,248 | $ | 94,394 | |||||||||||||||||||

| Depreciation and amortization | 29,209 | 27,310 | |||||||||||||||||||||

| Interest expense, net | 5,796 | 7,725 | |||||||||||||||||||||

| Provision for income taxes | 32,296 | 30,244 | |||||||||||||||||||||

| EBITDA | $ | 172,549 | $ | 159,673 | 12,876 | 8.1 | |||||||||||||||||

Fox acquisition-related expenses (1)

|

— | 1,049 | |||||||||||||||||||||

Gain on sale of assets, net (2)

|

(692) | 61 | |||||||||||||||||||||

| Adjusted EBITDA | $ | 171,857 | $ | 160,783 | 11,074 | 6.9 | |||||||||||||||||

| Revenues | $ | 822,504 | $ | 748,349 | 74,155 | ||||||||||||||||||

| EBITDA margin | 21.0 | % | 21.3 | % | |||||||||||||||||||

| Incremental EBITDA margin | 17.4 | % | |||||||||||||||||||||

| Adjusted EBITDA margin | 20.9 | % | 21.5 | % | |||||||||||||||||||

| Adjusted incremental EBITDA margin | 14.9 | % | |||||||||||||||||||||

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow and Free Cash Flow Conversion | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 146,892 | $ | 127,433 | |||||||||||||||||||

| Capital expenditures | (6,781) | (7,171) | |||||||||||||||||||||

| Free cash flow | $ | 140,111 | $ | 120,262 | 19,849 | 16.5 | |||||||||||||||||

| Free cash flow conversion | 133.1 | % | 127.4 | % | |||||||||||||||||||

27

ROLLINS, INC. AND SUBSIDIARIES

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Reconciliation of SG&A to Adjusted SG&A | |||||||||||

| SG&A | $ | 250,513 | $ | 223,057 | |||||||

Fox acquisition-related expenses (1)

|

— | 1,049 | |||||||||

| Adjusted SG&A | $ | 250,513 | $ | 222,008 | |||||||

| Revenues | $ | 822,504 | $ | 748,349 | |||||||

| Adjusted SG&A as a % of revenues | 30.5 | % | 29.7 | % | |||||||

|

Period Ended

March 31, 2025

|

Period Ended

December 31, 2024

|

||||||||||

| Reconciliation of Long-term Debt and Net Income to Leverage Ratio | |||||||||||

Long-term debt (5)

|

$ | 500,000 | $ | 397,000 | |||||||

Operating lease liabilities (6)

|

425,582 | 417,218 | |||||||||

Cash adjustment (7)

|

(181,059) | (80,667) | |||||||||

| Adjusted net debt | $ | 744,523 | $ | 733,551 | |||||||

| Net income | 477,233 | 466,379 | |||||||||

| Depreciation and amortization | 115,119 | 113,220 | |||||||||

| Interest expense, net | 25,748 | 27,677 | |||||||||

| Provision for income taxes | 165,903 | 163,851 | |||||||||

Operating lease cost (8)

|

141,057 | 133,420 | |||||||||

| Stock-based compensation expense | 31,602 | 29,984 | |||||||||

| Adjusted EBITDAR | $ | 956,662 | $ | 934,531 | |||||||

| Leverage ratio | 0.8x | 0.8x | |||||||||

(1) Consists of expenses resulting from the amortization of certain intangible assets and adjustments to the fair value of contingent consideration resulting from the acquisition of Fox Pest Control ("Fox"). While we exclude such expenses in this non-GAAP measure, the revenue from the acquired company is reflected in this non-GAAP measure and the acquired assets contribute to revenue generation.

(2) Consists of the gain or loss on the sale of non-operational assets.

(3) The tax effect of the adjustments is calculated using the applicable statutory tax rates for the respective periods.